Today we are going to explore the "C" in our MCGI framework, which stands for Compete. Let's look at an example. Say you are a mortgage lender serving the Tampa-St. Petersburg-Clearwater, FL MSA, and facing a very crowded competitive space.

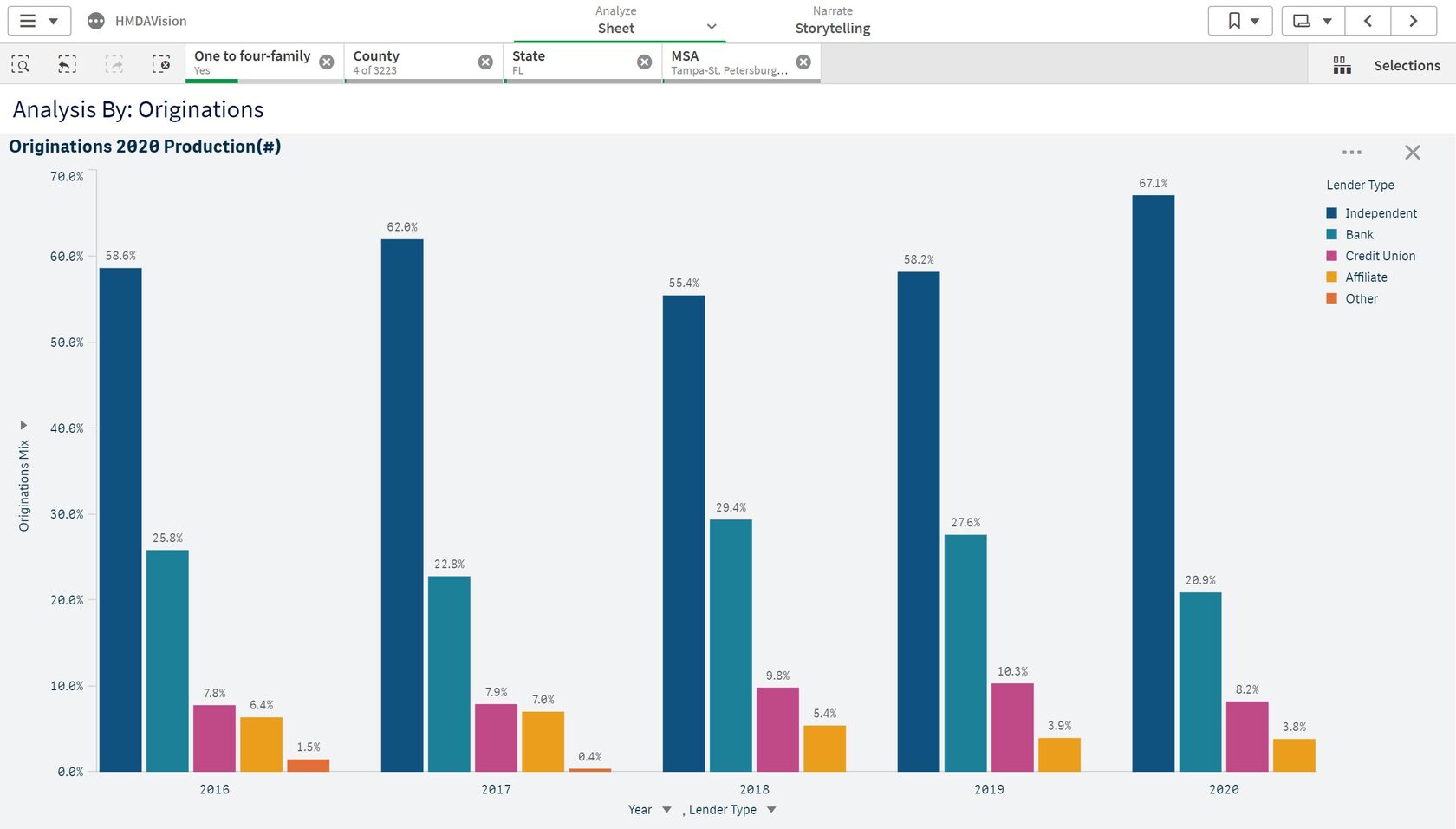

In 2020, there were over 1,100 active lenders in Tampa-St. Petersburg-Clearwater, FL MSA, 498 of which were independent mortgage bankers, 425 were banks, and the rest were credit unions and affiliates. The independent lenders were originating 67% of residential mortgage loans by grabbing market share from banks and other depositories. It's a concentrated market with for example Rocket Mortgage holding 8.3% of the mortgage originations in Tampa and Citibank holding 0.11%.

Figure1: Mortgage Market Share by Lender Type in Tampa-St. Petersburg, FL MSA

In such a competitive marketplace, you need to have a clear competitive strategy in order to compete, serve all potential customers/borrowers, and drive growth.

Where to begin?

A good place to start is to build a SWOT analysis (strengths - weaknesses - opportunities - threats). With the right data and tools, this type of analysis for the mortgage banking industry is straightforward. In Figure 2, we provide a scoped competitive analysis of the top 25 lenders, to begin this analysis.

Figure 2: Lender Competitive Analysis for Minority Lending in Tampa MSA

From Figure 2, you can pick one or two peers with good competitive position to analyze their product mix, pricing, loan life cycle, including underwriting, and sales workforce (loan officers) to glean the insights that you need to shape up your own competitive strategy.

To evaluate every aspect of your strengths, weaknesses, opportunities, and threats for this particular market, you need also to know the size of the market, the potential of this market for growth, the demographic drivers, the housing affordability, the loan products and mix in this market, your own market share, how you price your loans against peers and competitors, your closing/funding rate, among several other important factors. You need to have your pulse on leading indicators like housing starts, interest rate movement, early delinquency and foreclosure initiations.

It's beyond the purpose of this short blog to discuss in depth each aspect of a mortgage lender competitive strategy, but if you would like to explore this question for your market, we invite you to a free 30-minute data-driven exploration. In future blogs, we will revisit this question, and will provide additional elements of SWOT analysis for a mortgage lender.