Down payment assistance has been a tool to compensate for one of the key barriers to homeownership, i.e. a lack of adequate down payment on the purchase of a home.

Down payment assistance (DPA) programs have been in focus lately as lenders, consumer advocates, policy shops, and regulators are looking for ways to help first-time home buyers become homeowners. DPAs went through a period when they were largely discontinued due to the increase in defaults on loans using a DPA. There is still much debate about this issue, but in this blog we want to focus on the DPA business landscape and market trends today - particularly in the government lending sector.

The U.S. Department of Housing and Urban Development (HUD) provides grants to state and local organizations through the HOME Investment Partnerships Program and the Community Development Block Grant Program. State and local housing finance agencies (HFAs) administer many of these programs. The three main types of down payment assistance are grants, second mortgage loans, and tax credits.

- Grants – Grants are funds that the borrowers do not have to pay back as long as they own and occupy their home for a certain period of time.

- Second mortgage loans – The most common form of down payment source is the second mortgage. Many second mortgage loans offered by state and local governments have low or zero interest rates, and the payments are deferred over a specified time span and, in many cases, the loan is completely forgiven over time.

- Tax credits – Certain states and local governments, including HFAs, issue mortgage credit certificates, which reduce the amount of federal income tax the borrowers pay. This makes more money available upfront for the down payment or the closing costs.

So what are the key facts and trends about the use of DPA in government lending (i.e. FHA, VA, and USDA)?

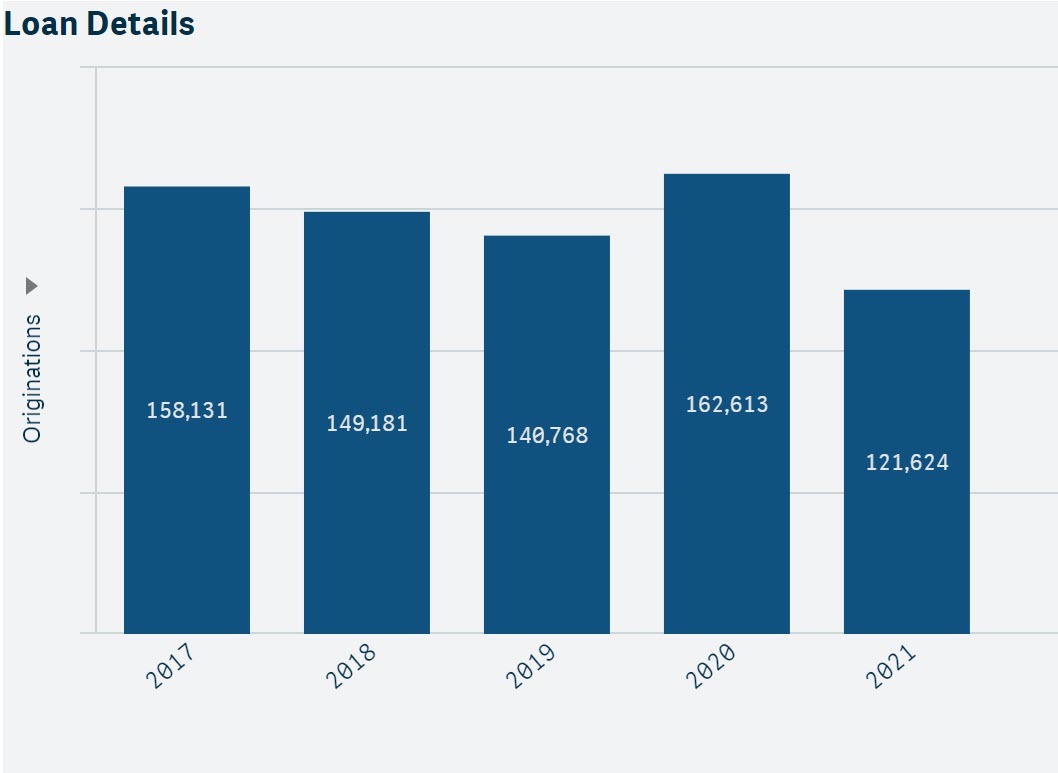

121,624 purchase mortgage loans with DPA ($30.2 Billion) were originated in 2021 (source: Polygon Research analysis in GovLoansVision of Ginnie Mae loan-level disclosure data set updated through January 2022).

Figure 1: Annual DPA purchase money originations (number of loans)

Top 3 Non-Depository issuers::

- Lakeview Loan Servicing

- Idaho HFA

- Rocket Mortgage, LLC

- U.S. Bank, N.A.

- Citizens Bank, N.A.

- Gateway First Bank (Gateway Mortgage)

We are keeping a close eye on DPA loan originations performance, including the 30-60-90+ delinquency rates, forbearance, and liquidations. If you would like to see how this picture looks for your state, schedule a 15-minute free data exploration call with us.