The latest FHA Pivot update for April 2024 brings encouraging news for the housing market showing higher production of FHA loans in each of the first four months. This surge is not just good news for first-time homebuyers; existing homeowners are also benefiting from the favorable trends.

2024 year-to-date FHA endorsement activity was higher than 2023 with a total of 240,086 loans and $72.16 Billion in FHA loan volume.

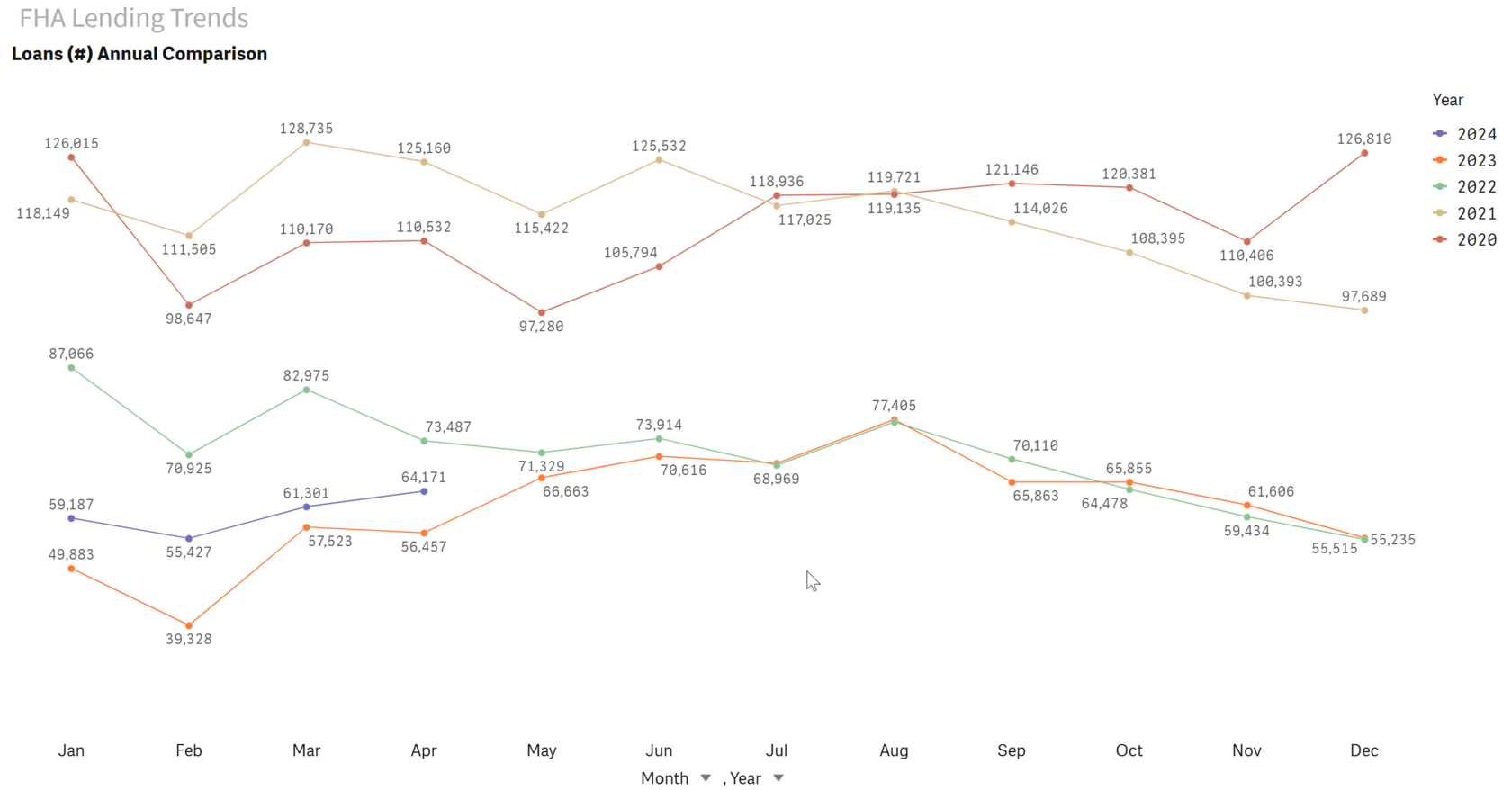

As you can see in the snapshot of FHA Lending Trends in FHA Pivot (just updated with the latest data), 2024 started strong with 59,187 loans in January, increasing to 61,301 in March, and peaking at 64,171 in April. In contrast, the numbers were lower throughout the same period in 2023, with 49,883 loans in January and a slight increase to 57,523 in March, followed by a dip in April.

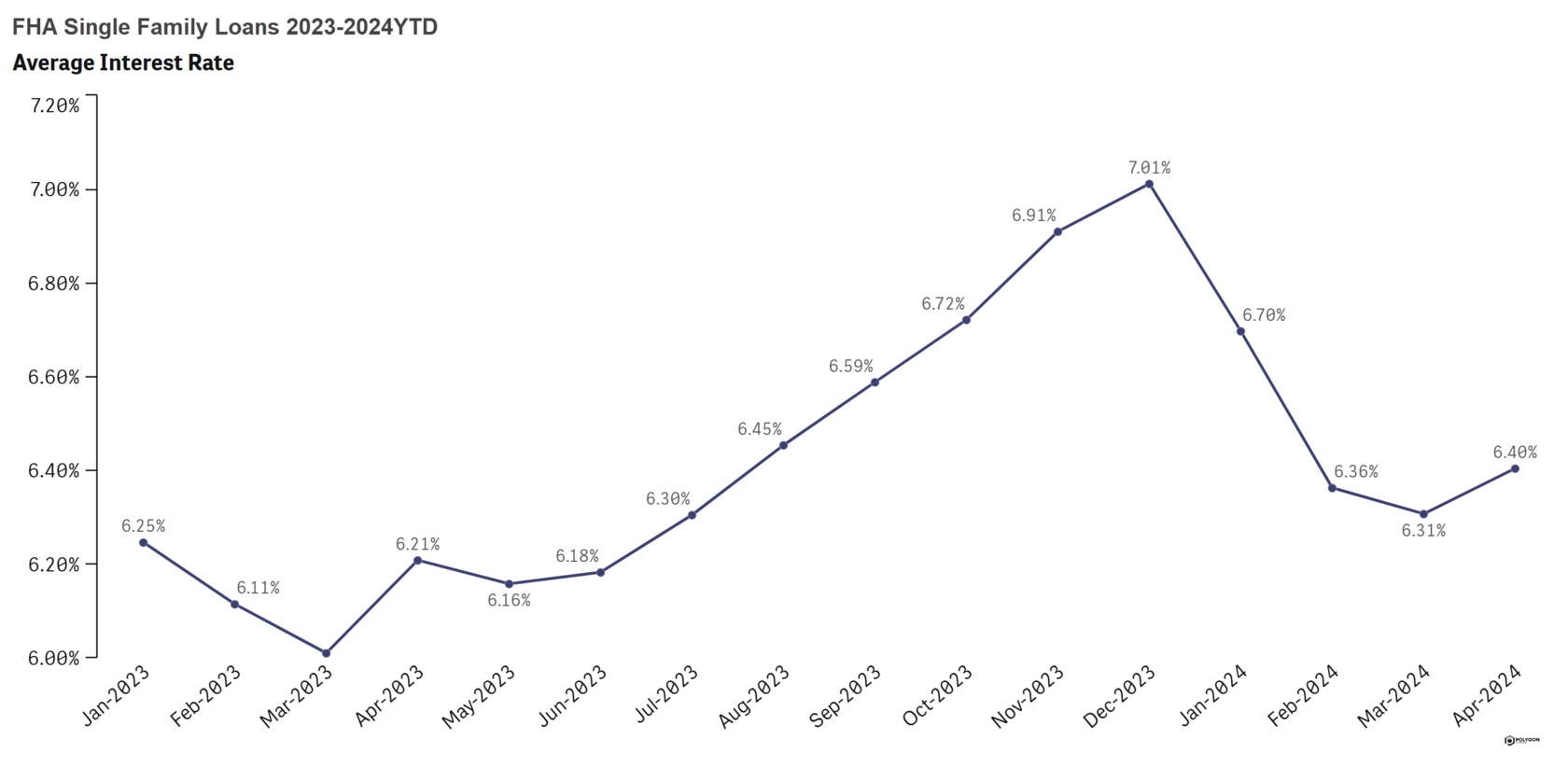

The average interest rate on all FHA loans briefly peaked at just above 7% in December 2023 but then came down to an average of 6.44% 2024 year-to-date.

FHA Home Purchase Loans Meet First-Time Home Buyer Need

The rise in FHA lending despite of the elevated interest rates is particularly promising for first-time homebuyers, who often face challenges in securing traditional mortgages due to stricter requirements. FHA loans offer a more accessible path to homeownership with lower down payment options and flexible credit score criteria. The increased availability of FHA loans in 2024 means more opportunities for aspiring homeowners to step onto the property ladder and achieve their dream of owning a home.

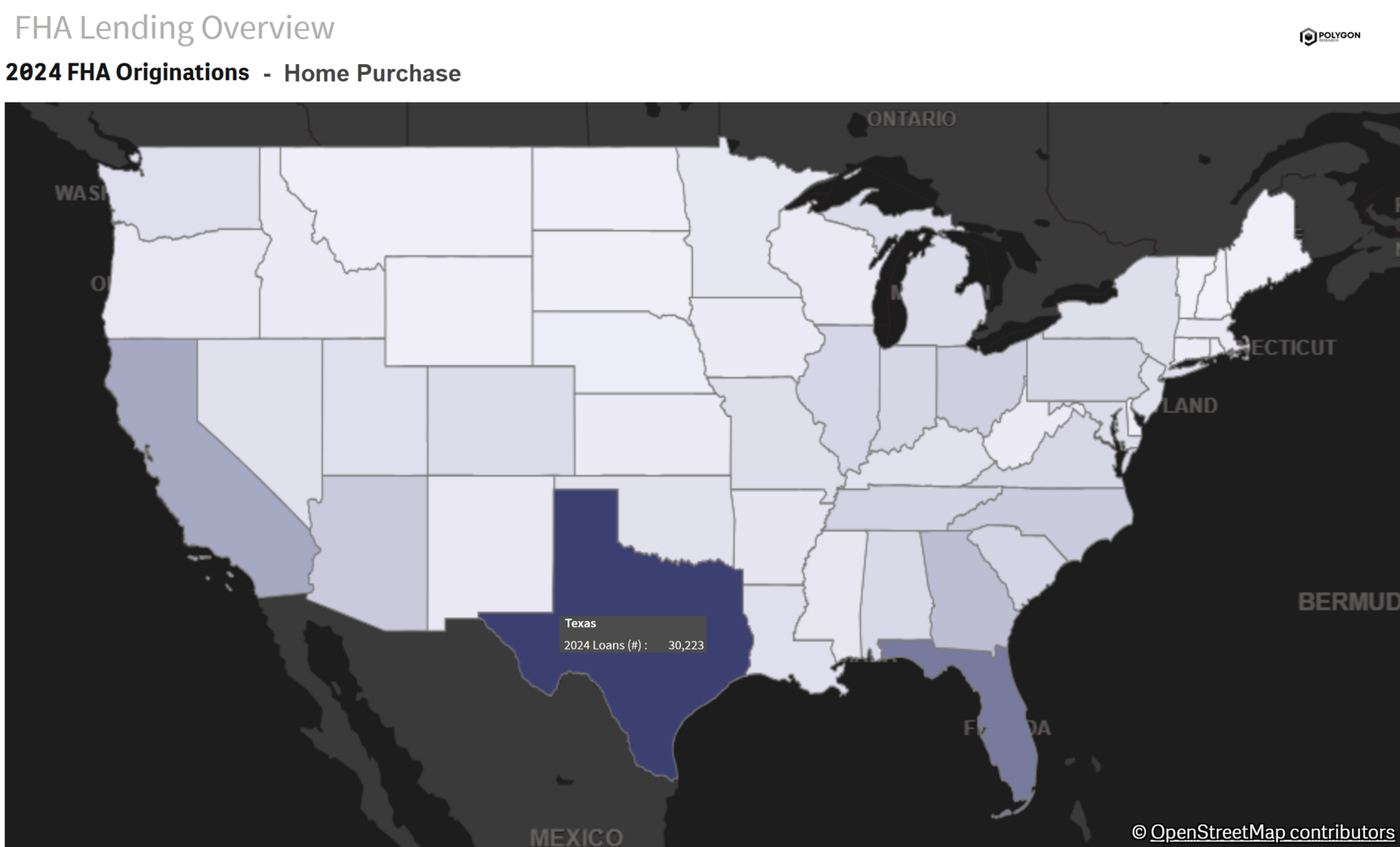

FHA-insured home purchase loans totaled 186,746 for the first four months of 2024. As the heat map shows, Texas is the number one state for these loans. Texas also had the lowest average interest rate of 6.18% 2024YTD for FHA-insured purchase loans.

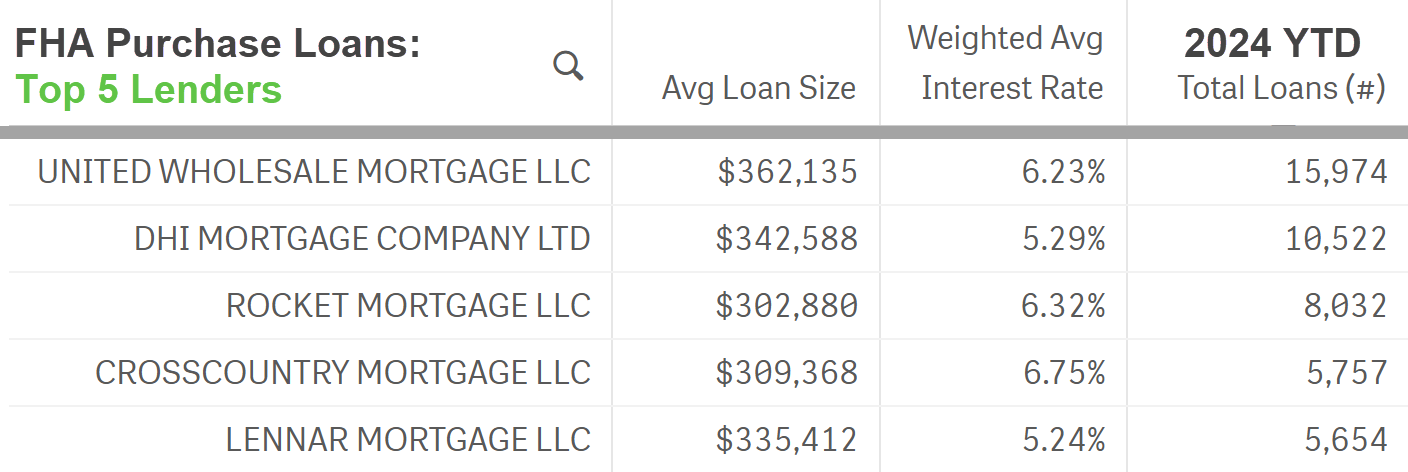

Among the top five FHA home purchase lenders nationwide, two are lenders owned by builder companies - DHI Mortgage and Lennar Mortgage.

Refinancing to FHA Offers Savings for Some Existing Homeowners

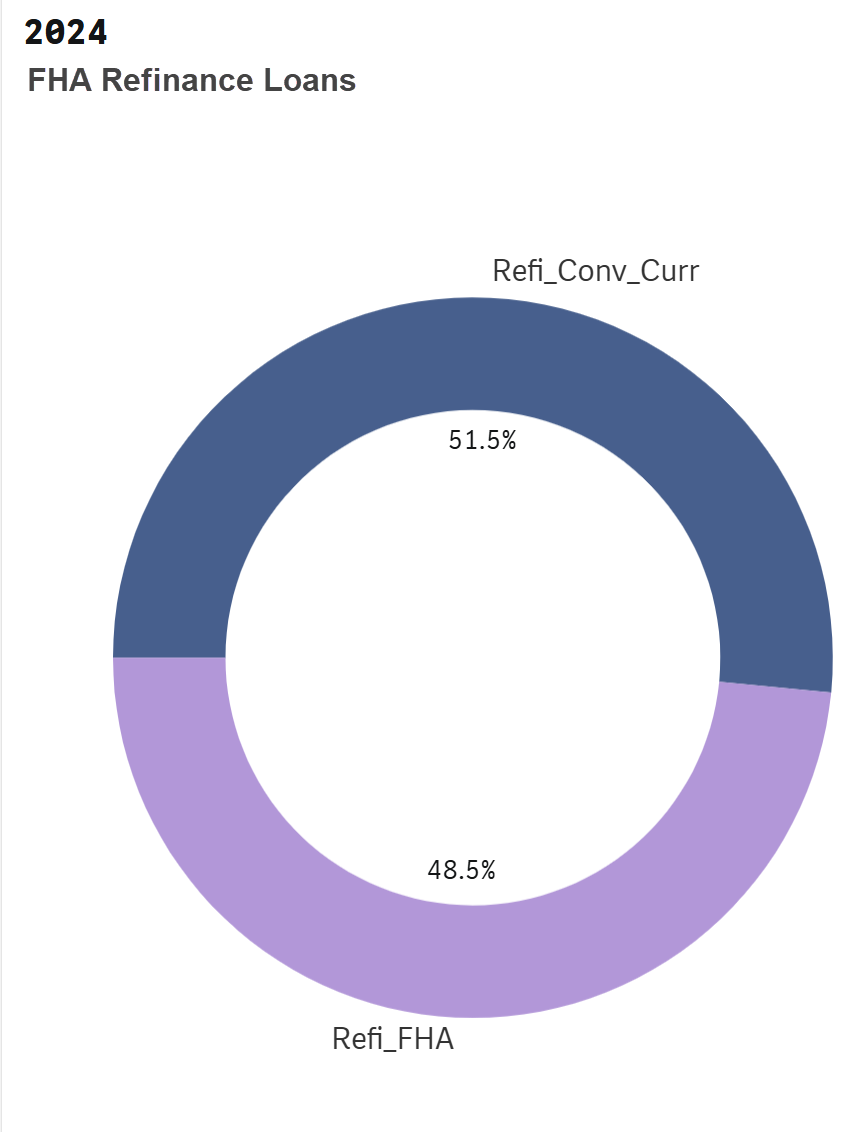

The data in the pie chart below also highlights a notable trend: more than half of FHA refinance loans are from conventional loans converting to FHA. This indicates that existing homeowners are recognizing the potential benefits of FHA loans, especially in terms of lower interest rates. We used insights from the RMBS market in MBS Pivot to draw comparison between FHA and Conventional rate-and-term refinance outcomes. On average FHA refinance loan had an interest rate of 6.29% vs. 6.62% for a Conventional refinance (source: MBS Pivot, updated through May, reflects Jan-April RMBS loan originations).

By refinancing their existing mortgages into FHA loans, homeowners can significantly reduce their monthly payments, freeing up more disposable income or accelerating their debt repayment.

By refinancing their existing mortgages into FHA loans, homeowners can significantly reduce their monthly payments, freeing up more disposable income or accelerating their debt repayment.

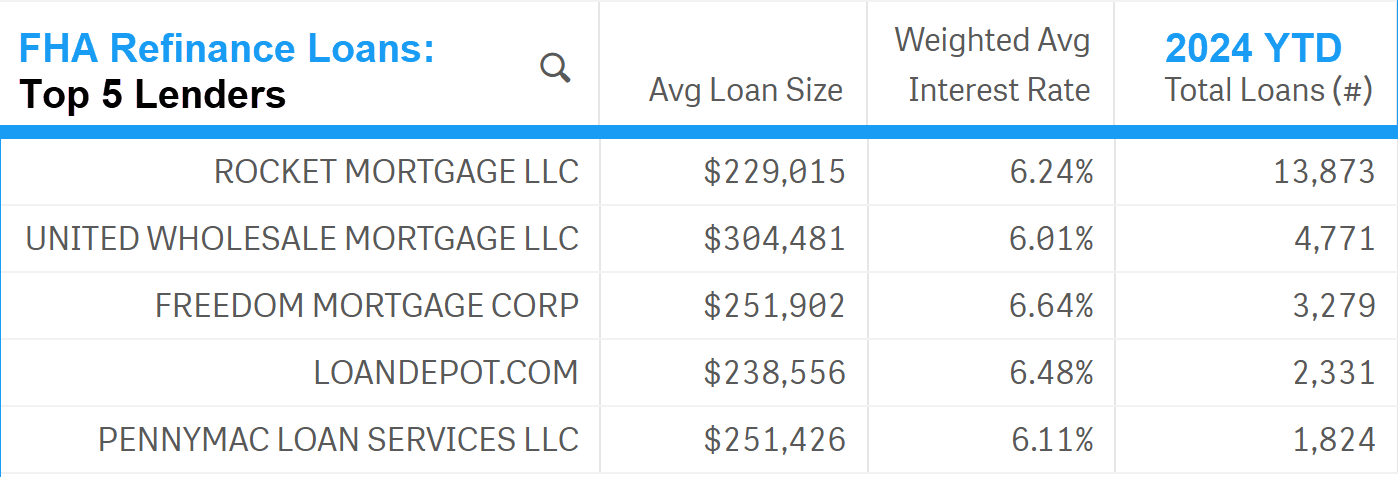

The top 5 lenders for FHA Refinance Loans are all independent mortgage bankers. See the table below.

What's Driving the FHA Lending Boom?

Several factors are contributing to the surge in FHA lending:

Reduced FHA Insurance Premiums

Strong Housing Market

- One significant change that likely contributed to this improvement is the reduction in the annual mortgage insurance premium by the FHA. On February 22, 2023, the Biden-Harris administration announced a reduction in the annual Mortgage Insurance Premium (MIP) for FHA loans by 30 basis points, lowering it from 0.85% to 0.55% for most new FHA loans. This change became effective on March 20, 2023. The primary goal of this reduction was to make homeownership more affordable for low- and moderate-income borrowers by decreasing their monthly mortgage payments. This initiative is expected to save FHA borrowers, on average, about $800 annually. The administration emphasized that this reduction supports their broader goals of enhancing homeownership accessibility and addressing historic disparities, particularly benefiting first-time homebuyers and households of color.

Strong Housing Market

- A robust housing market with consistent demand for homes has fueled the need for mortgage financing, leading to increased interest in FHA loans.

The Bottom Line

The latest FHA lending trends paint a positive picture for the housing market, signaling increased accessibility for first-time homebuyers and financial advantages for existing homeowners seeking to refinance. If you're considering buying your first home or looking to refinance your existing mortgage, exploring FHA loan options could be a smart move in the current market.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any major financial decisions.