Analyzing loan origination channels is essential for understanding the complex dynamics of the mortgage market. To gain a holistic view, it's crucial to examine data from multiple sources, including the Home Mortgage Disclosure Act (HMDA), secondary market data like mortgage-backed securities (MBS) disclosures, and FHA endorsement loan-level data. In this post, we'll explore Polygon Research’s methodologies1 for using these datasets to derive meaningful insights into origination channels.

Used in our flagship HMDA analysis tool HMDAVision®.

HMDA Data and the Loan Channel Field

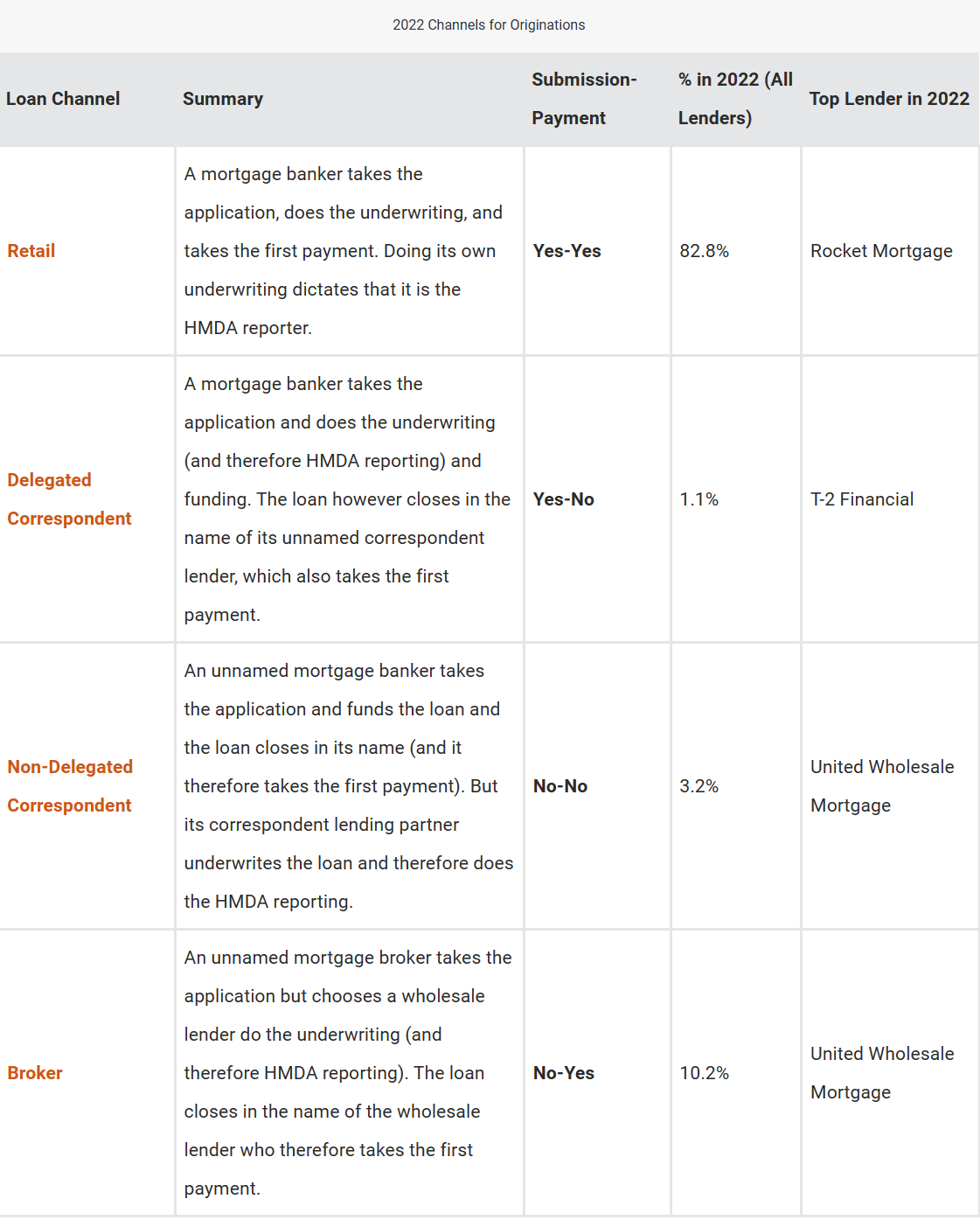

Loan Channel is an engineered field that with one exception (discussed below) is built from 2 underlying, native HMDA fields. From the perspective of the reporting lender, these fields have to do with whether the loan application is submitted directly to the lender, and whether the first loan payment is submitted directly to the lender. It is important to understand that these fields operate at the loan level - any given lender can originate loans in multiple channels.

1. submission_of_application (Loan Channel - Submission): Indicates whether the loan application was submitted directly to the reporting lender.

2. initially_payable_to_Institution (Loan Channel - Payment): Reveals whether the first loan payment is made directly to the reporting lender.

The main values for these fields are simply Yes and No. For example, Yes for the first field indicates that the loan was submitted directly to the reporting lender. This leads to 4 possible combinations. We list them below, with their percentage of originations in a given year (2022) and the leading lender for each. For the non-Retail channels there is an unnamed company – a broker or a correspondent counterparty – working with the HMDA reporter.

1. submission_of_application (Loan Channel - Submission): Indicates whether the loan application was submitted directly to the reporting lender.

2. initially_payable_to_Institution (Loan Channel - Payment): Reveals whether the first loan payment is made directly to the reporting lender.

The main values for these fields are simply Yes and No. For example, Yes for the first field indicates that the loan was submitted directly to the reporting lender. This leads to 4 possible combinations. We list them below, with their percentage of originations in a given year (2022) and the leading lender for each. For the non-Retail channels there is an unnamed company – a broker or a correspondent counterparty – working with the HMDA reporter.

HMDA also includes a separate category for Purchased Loans, identified by the Action code 6. These loans, purchased post-origination, should be excluded when analyzing new loan volume to avoid double-counting.

Bridging the Gap: HMDA and Secondary Market Data

Secondary market data sources, such as MBS disclosures, categorize origination channels as Retail, Broker, and Correspondent. The MBS Correspondent channel comprises:

The close alignment between the volume of loans sold to non-Agency purchasers in HMDA and the MBS Correspondent volume validates this interpretation of the flow of loans into the MBS Correspondent channel.

- Delegated and Non-Delegated Correspondent loans sold to agencies

- Loans originated across all channels in a given year, then purchased within the same year by lenders who subsequently sell to agencies

The close alignment between the volume of loans sold to non-Agency purchasers in HMDA and the MBS Correspondent volume validates this interpretation of the flow of loans into the MBS Correspondent channel.

Incorporating FHA Endorsement Data

FHA endorsement loan-level data provides additional insights into origination channels, albeit with limited data fields. At Polygon Research, we define channels in FHA data as follows:

- Retail: Loans originated without a sponsor, i.e., by an originating lender with direct endorsement approval.

- Wholesale (broker): Loans originated by a sponsored originator without direct endorsement approval, relying on a sponsor with direct endorsement approval to underwrite the loan.

Channel View Across Datasets Case Study: Rocket Mortgage’s FHA Loans

To demonstrate the power of integrating channel insights across datasets, let's examine the flow of FHA loans for one lender - Rocket Mortgage - through the lens of HMDA, MBS, and FHA endorsement data.

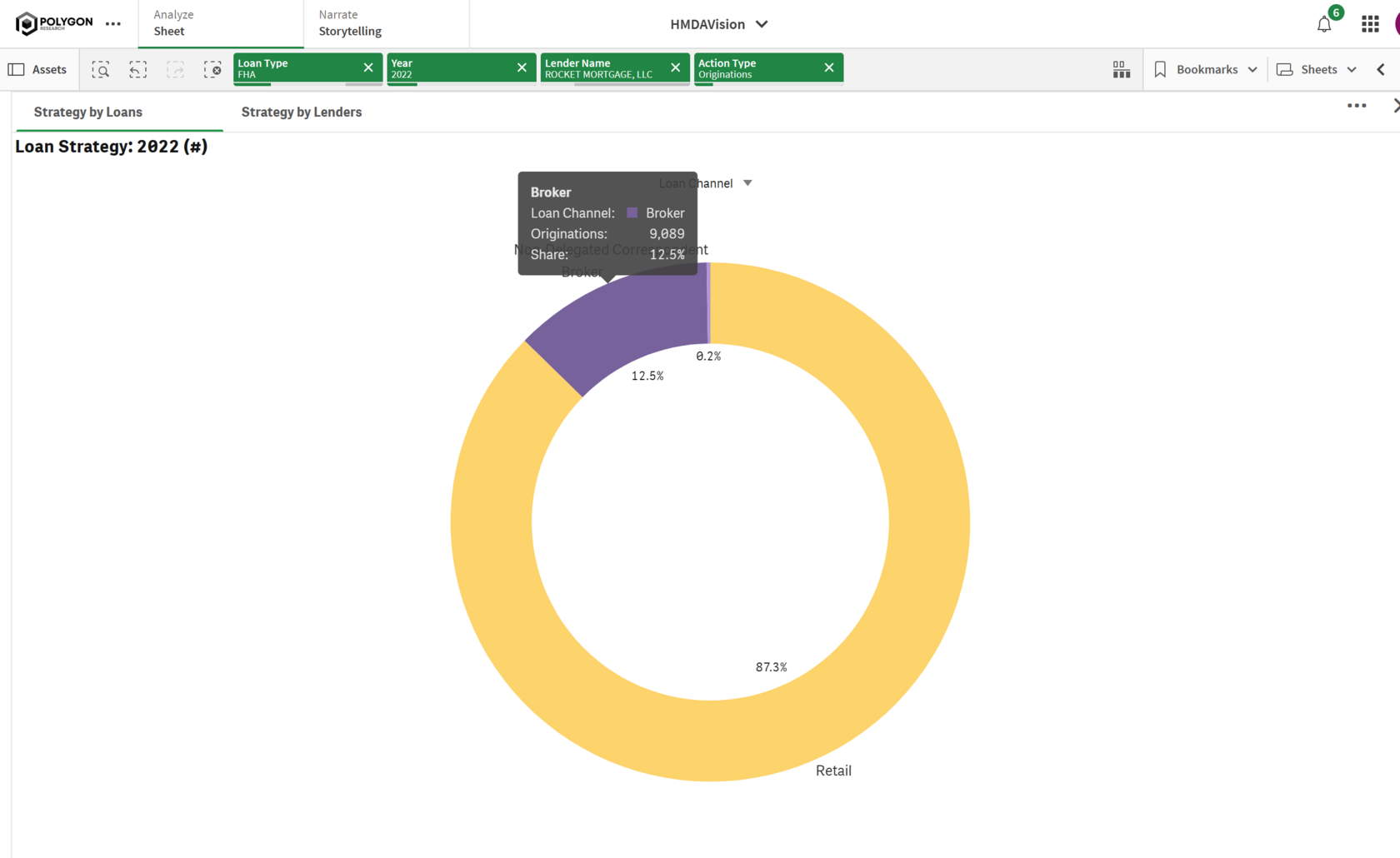

HMDA Data

In 2022, Rocket Mortgage's originations were predominantly in the Retail channel (87.3%), with Broker accounting for 12.5% and a small portion in other channels.

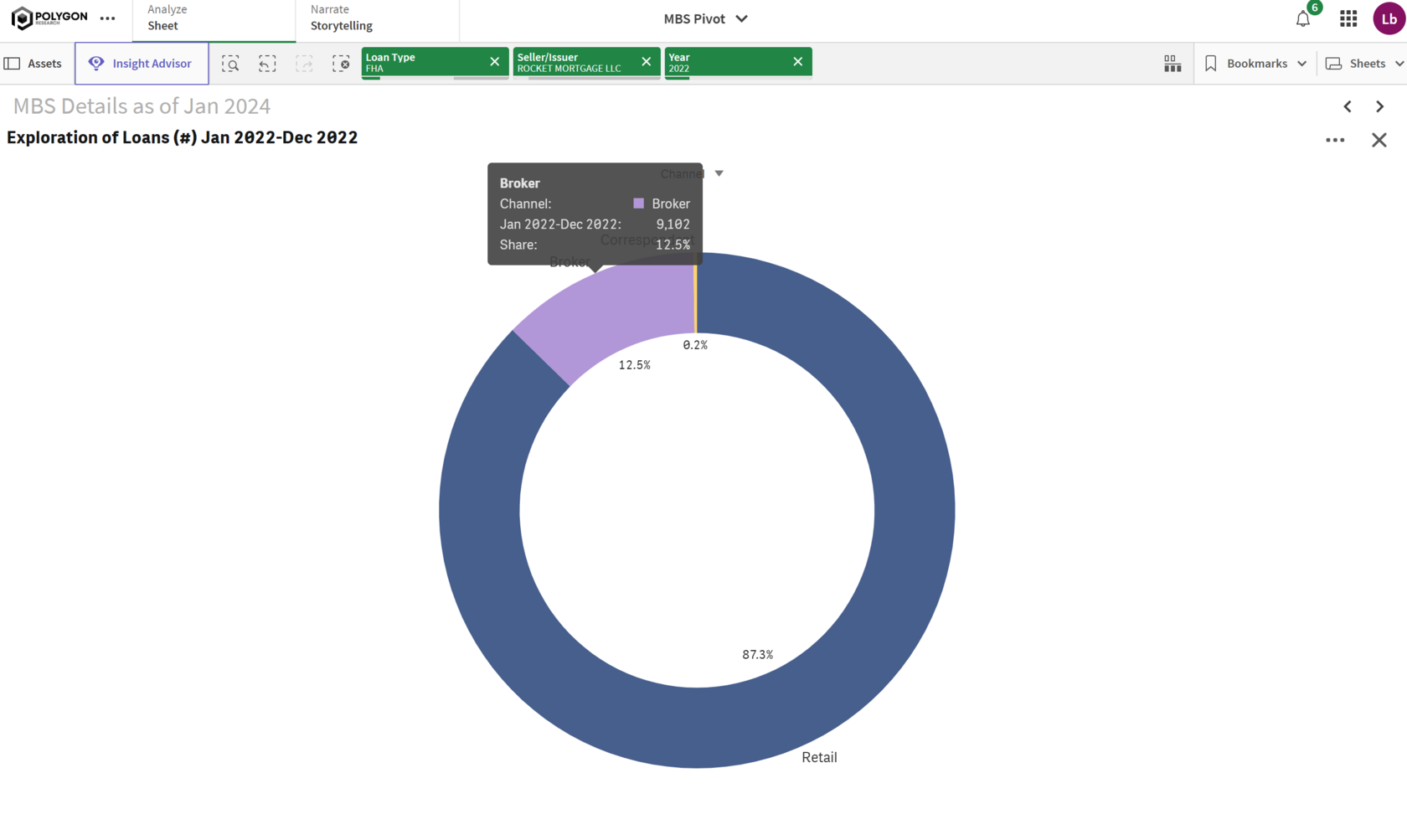

Rocket Mortgage's channel distribution in the secondary market closely aligns with its HMDA originations. In the Jan 2022-Dec 2022 period, 87.3% of its MBS volume came from Retail, and 12.5% from Broker.

MBS Data

Rocket Mortgage's channel distribution in the secondary market closely aligns with its HMDA originations. In the Jan 2022-Dec 2022 period, 87.3% of its MBS volume came from Retail, and 12.5% from Broker.

FHA Endorsement Data

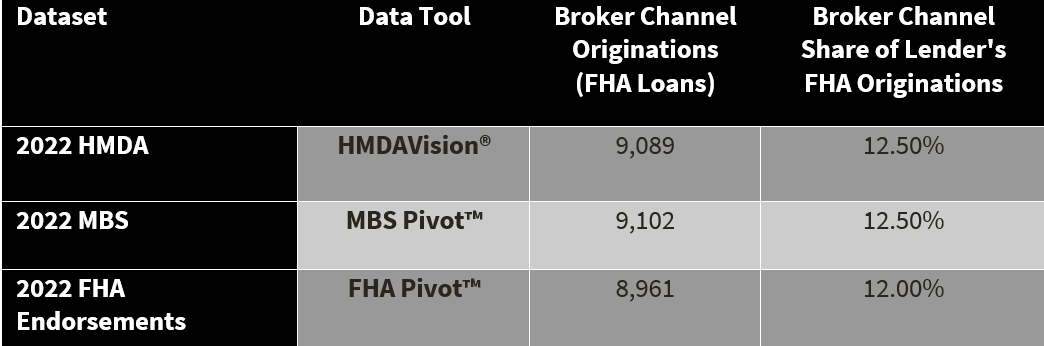

Rocket Mortgage's 2022 FHA endorsements also show a similar pattern, with 88.0% in Retail and 12.0% in Wholesale (analogous to the Broker channel).

The close alignment of broker channel proportions across these three datasets underscores the consistency of insights available about this lender’s channel origination strategy. The minor differences can be attributed to the unique characteristics and limitations of each dataset.

The table summarizes this analysis for Rocket’s 2022 FHA loan originations strategy.

The table summarizes this analysis for Rocket’s 2022 FHA loan originations strategy.

This case study exemplifies the value of analyzing origination channels through multiple lenses. By analyzing multiple data sets, mortgage industry stakeholders can conduct rich, loan-level, and geographically specific analyses to gain a holistic understanding of lenders' channel strategies. Further analysis of the data sets we have been discussing provide complementary insights into the entire application lifecycle, pricing, and loan performance by channel.

Summary and Conclusion

Integrating data from HMDA, secondary market sources, and FHA endorsements enables a comprehensive, multi-dimensional understanding of loan origination channels. By carefully aligning channel definitions, accounting for each dataset's idiosyncrasies, and leveraging powerful analytical tools like the ones created by Polygon Research, stakeholders can uncover invaluable insights into the mortgage market's dynamics. The key lies in properly distinguishing between originations and purchases, understanding the nuances in channel classifications, and leveraging the strengths of each data set. By applying these methodologies, stakeholders can uncover valuable insights, make data-driven decisions, and navigate the ever-evolving mortgage landscape with greater clarity and confidence.

The Rocket Mortgage case study presented here illustrates the potential of this approach, showcasing, how a lender's origination strategy can be consistently traced across datasets. By embracing such robust, data-driven analyses, industry participants can make informed decisions, identify trends, and navigate the ever-changing mortgage landscape with greater confidence and clarity.

The Rocket Mortgage case study presented here illustrates the potential of this approach, showcasing, how a lender's origination strategy can be consistently traced across datasets. By embracing such robust, data-driven analyses, industry participants can make informed decisions, identify trends, and navigate the ever-changing mortgage landscape with greater confidence and clarity.