Manufactured housing accounts for more than five percent of occupied housing units in the U.S. and, according to a CFPB report, it is "the largest source of unsubsidized affordable housing in the country."

So we wanted to dig deeper and understand more about its size and dynamics. While there is not one single ideal data set for analyzing the manufactured home segment, we find that HMDA LAR data and U.S. Census data are great sources of information. We model these in our interactive apps, HMDAVision and CensusVision, simplifying and speeding up the analysis of this market segment.

Here are a few insights from CensusVision:

- 6.7 Million Manufactured occupied housing units

- 71.8% Homeownership rate (higher than the site-built homeownership rate of 63.7%)

- 17.4 Million people live in manufactured homes

- $955 Monthly median gross mortgage payment on manufactured home loans

- $750 Monthly median gross rent payment for manufactured homes

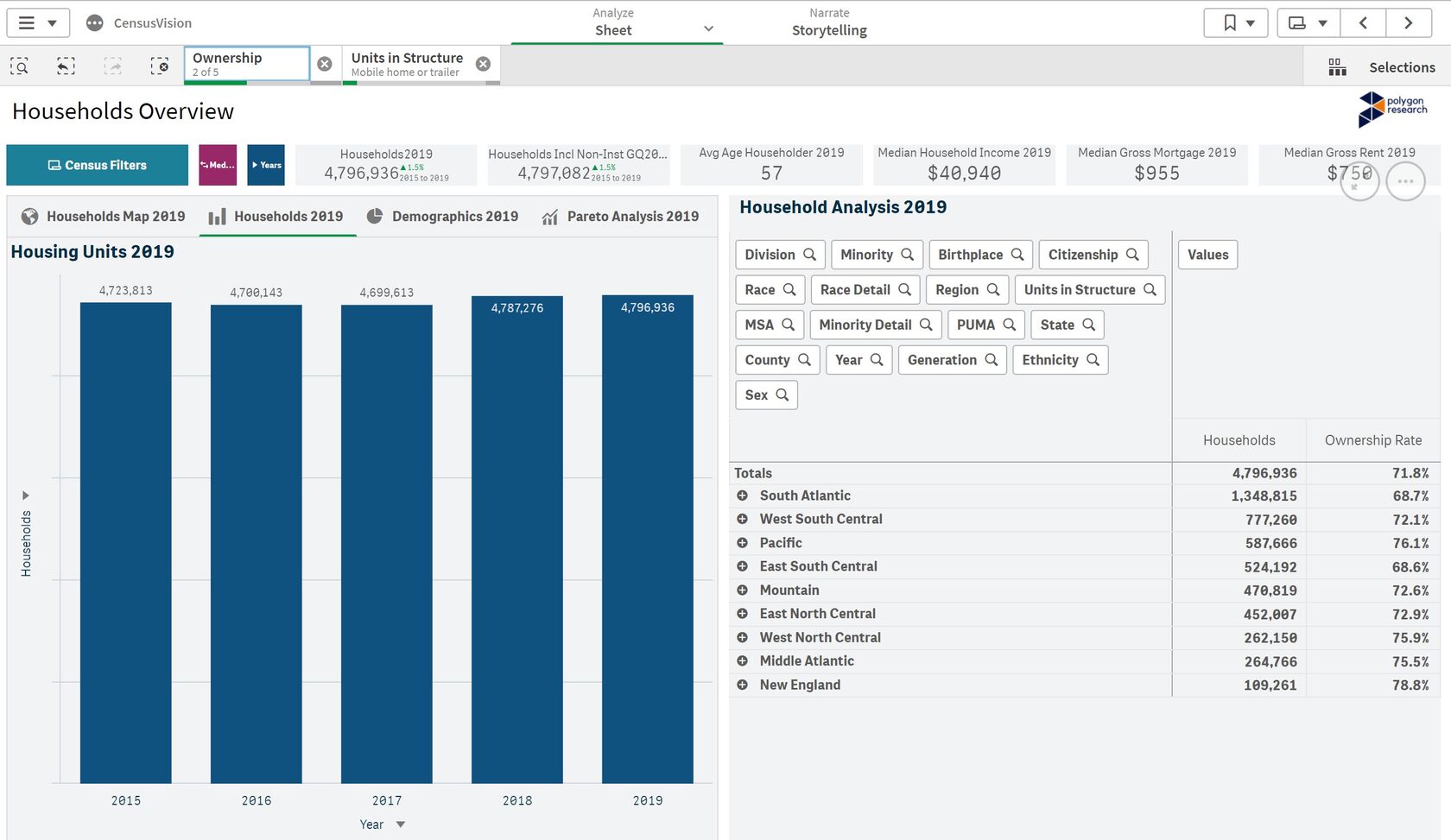

The manufactured homes represent about 5.4% of the occupied housing units in the U.S. and about 6% of properties purchased per year. Fig.1 provides an insight into the size of the U.S. manufactured home segment by year, and by U.S. census division, including the homeownership rate per division.

Fig. 1: Manufactured occupied housing units 2015-2019

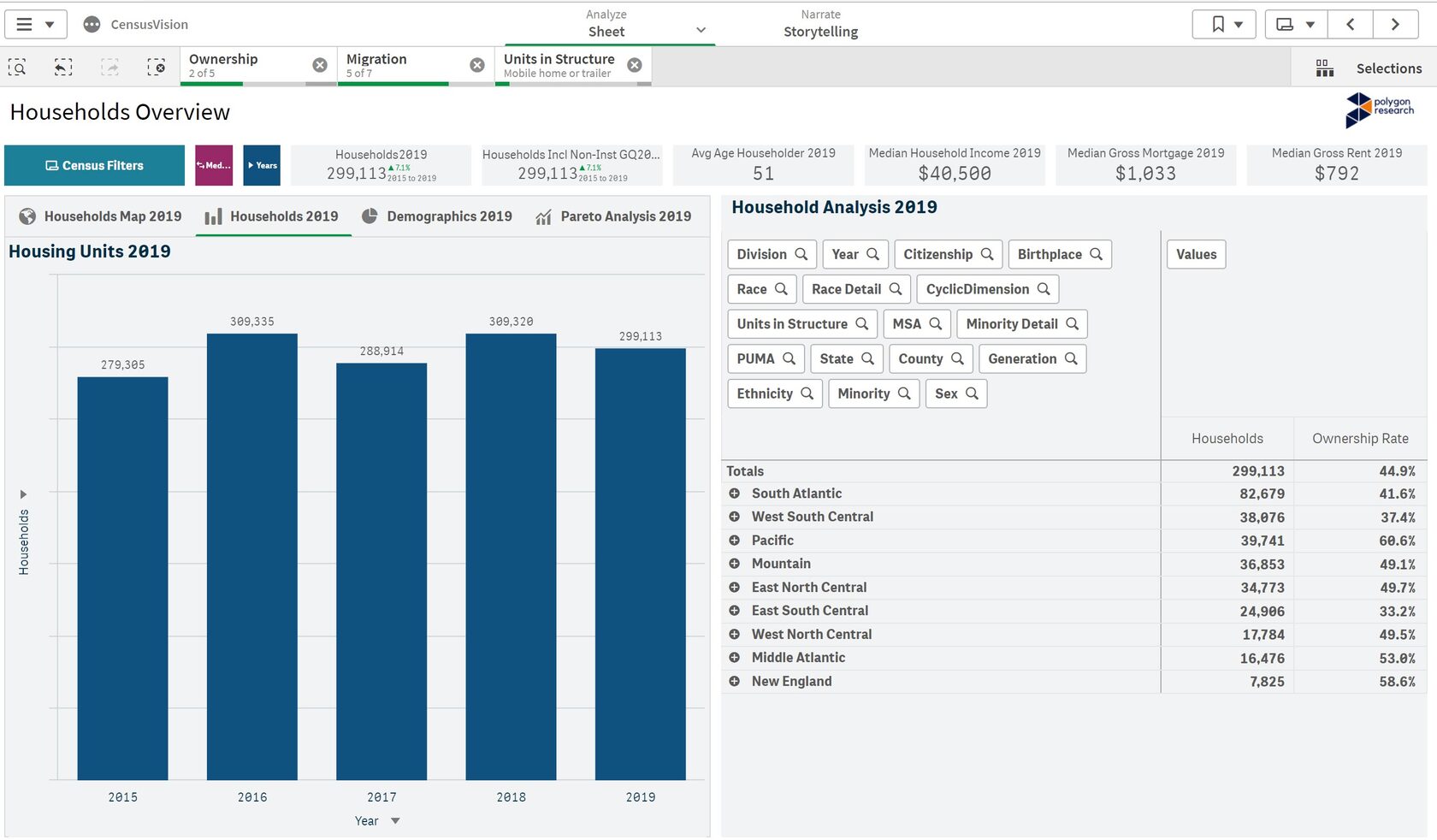

Recent Manufactured Buyers and RentersIn CensusVision, we can narrow the analysis to recent buyers (movers) to understand even better the dynamics in this property segment. As Fig. 2 shows, in the last 5 years, the average number of purchased manufactured homes has hovered around 297,000 per year.

Fig. 2: Manufactured Occupied Units by Year and Homeownership Rate by Division

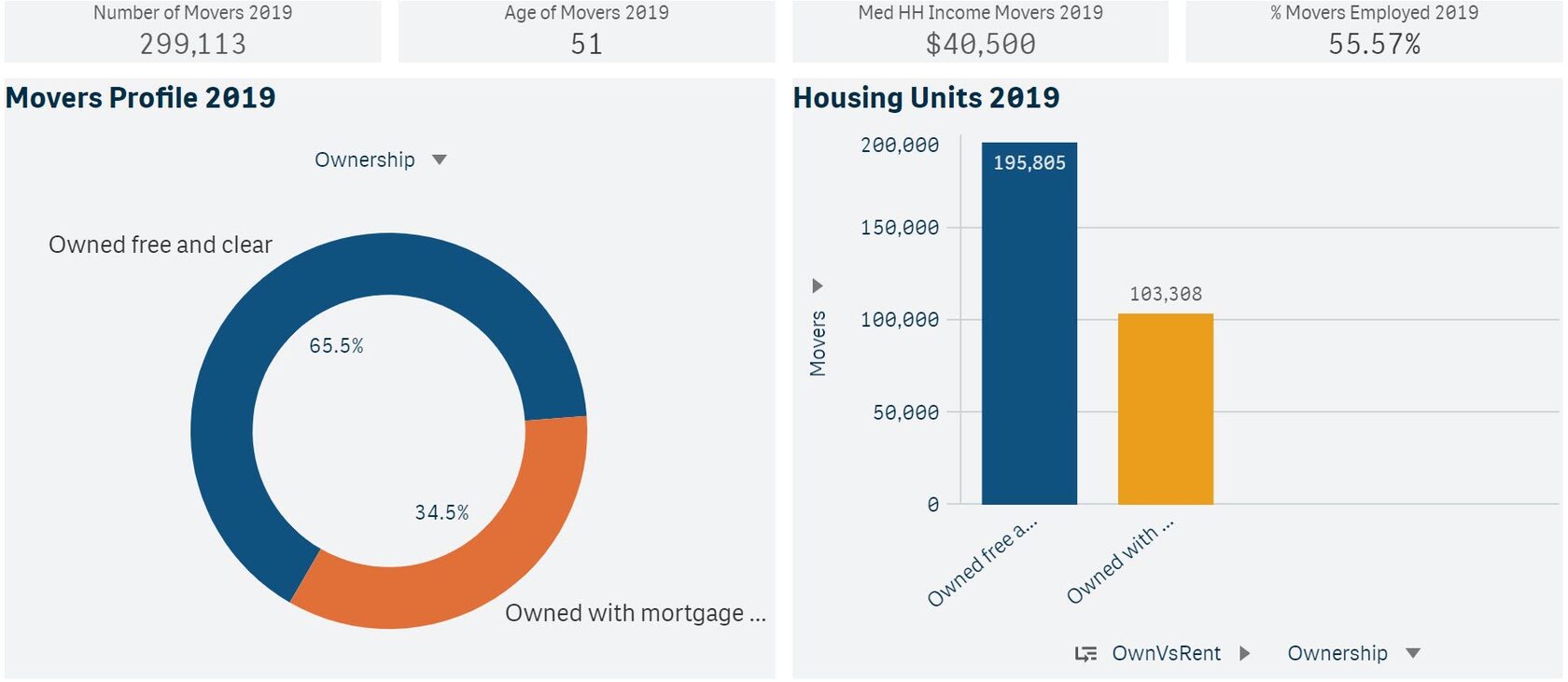

299,113 manufactured homes were bought/owned in 2019. As Fig. 3 illustrates, the breakdown of cash versus mortgage is 65.5% cash buyers vs 34.5% buyers with mortgage. The buyers of manufactured homes who took a mortgage to purchase a home were about 103,308.

Fig. 3: How buyers of manufactured homes financed their purchase

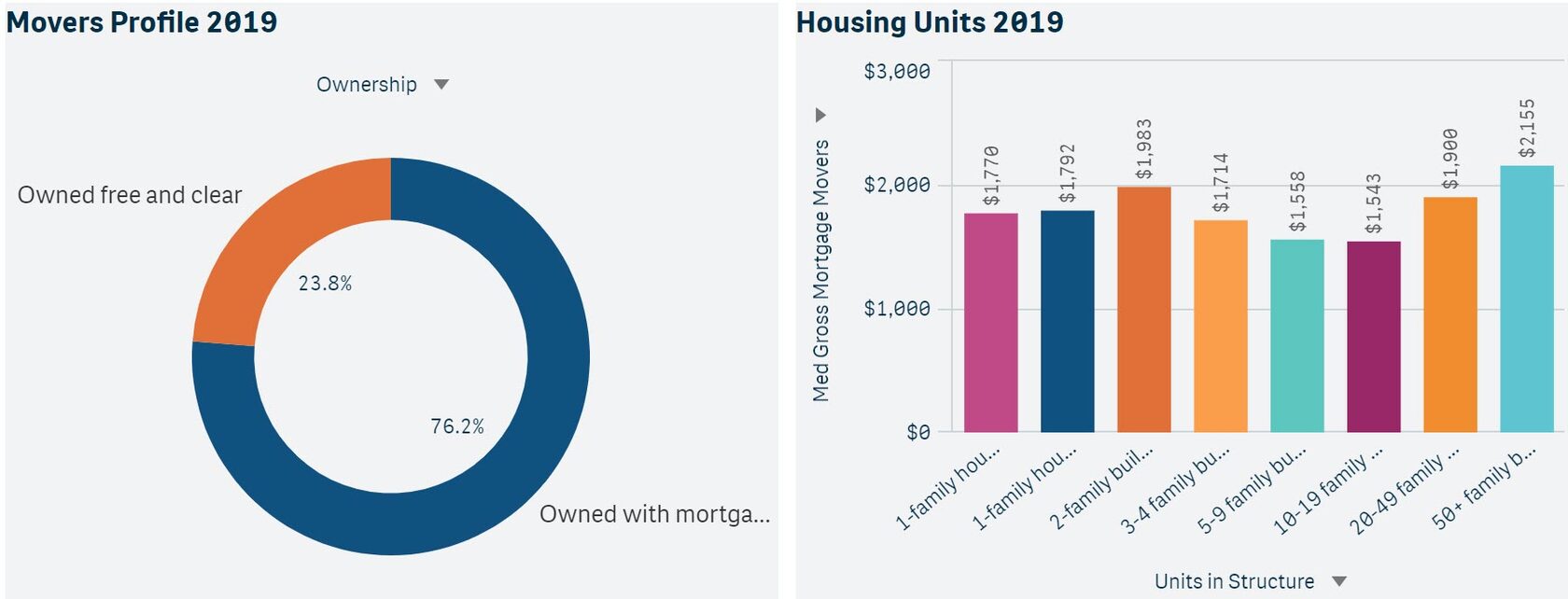

The cash vs. mortgage balance for manufactured homes is the reverse of the cash vs. mortgage balance for site-built property types. As Fig. 4 illustrates, 76.2% of site-built property's buyers use a mortgage to finance their purchase and only 23.8% use cash (or own free and clear). The median gross monthly gross mortgage payments are of course also higher for site-built than manufactured homes.

Fig.4: How buyers of site-built properties are financing their purchase

The Manufactured Home Mortgage OpportunityIt is not easy, however, to obtain a mortgage for a manufactured home. The process is lengthy and complicated because it attempts to inform and protect consumers and interested parties in the transaction. As one stakeholder explained, purchase transactions likely include a Lender, Realtor, Title Company, Escrow Agent, Appraiser, Mortgage Insurer, Property Inspector, Termite Inspector, and Vendors supplying technology services, recording services, flood zone research, and about a dozen more. This complicated process produces a flurry of activity and mountains of documents. We've heard from this stakeholder that in a recent manufactured home mortgage transaction, he counted

"17 pages in the purchase agreement, 37 pages the title search, 17 pages in the inspection report, 4 pages in the termite report, +100 emails/text messages to and from the Realtor trying to tie all the elements together – and the borrower is still 30 days away from a closing date".

It is no surprise then, that the originations rate for a manufactured home loans is about 25% (vs. 71.4% for site-built home purchase loans).

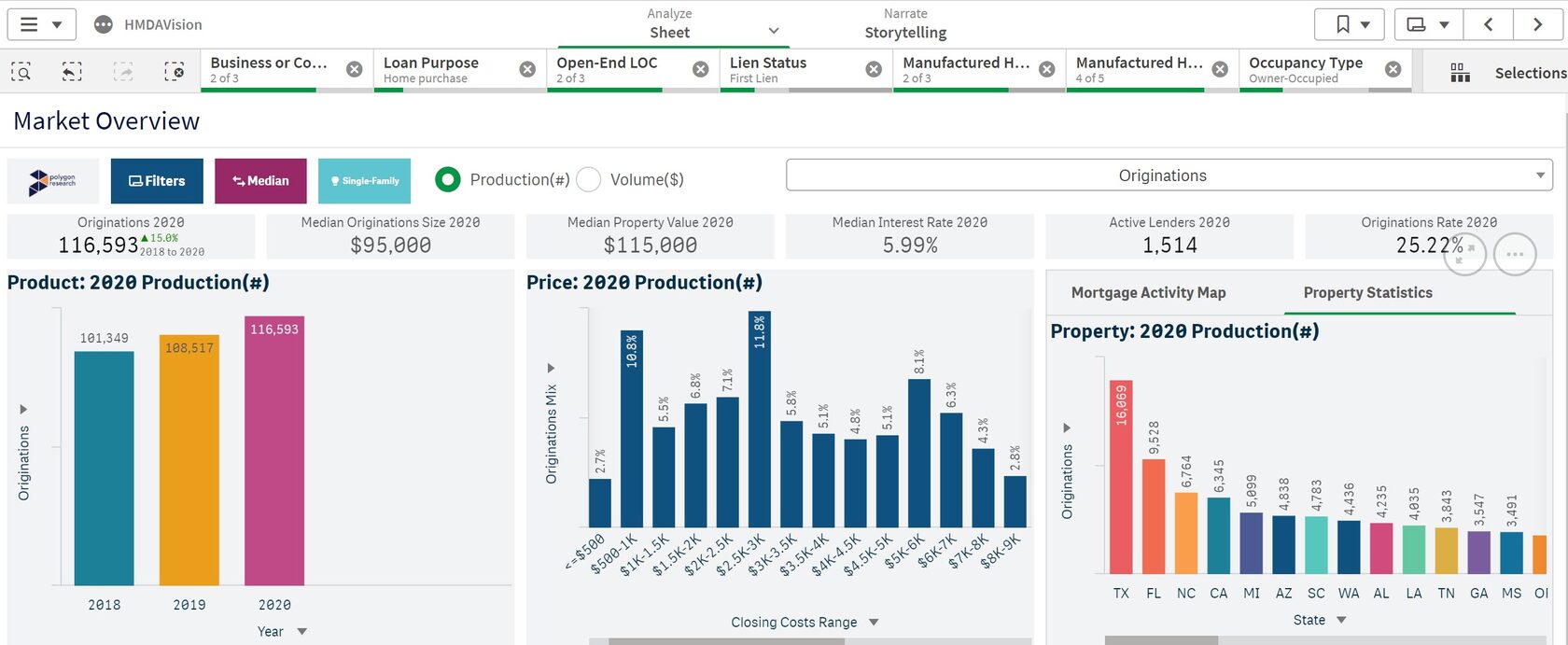

The applications for manufactured home mortgages increased 14% year-over-year in 2020, but manufactured home purchase originations increased only about 7%. Those lenders who figure out a simpler process will be able to serve the affordable housing needs of their communities better than those lenders who don't try. Fig. 5 shows at a glance the state of manufactured home lending in 2020, the latest HMDA LAR data available. We will be updating HMDAVision in a few weeks when the CFPB releases its 2021 HMDA LAR data, and we are eager to see how this segment has changed.

Fig. 5: Manufactured Home Purchase Originations

Source: Polygon Research: HMDAVision

From the most recent available data, we see that the median value of a manufactured home financed with mortgage was $115,000, the median loan size was $95,000 with a 5.99% annual interest rate, and the estimated median gross monthly mortgage payment (including taxes and insurance) was $1,033 (as shown in the KPIs in Fig. 2) - lower than the median gross monthly mortgage payment for all other property types as shown in Fig. 4. The top 3 states for manufactured home originations were TX, FL, and NC.

The analysis of financing manufactured home purchases is extends farther than the scope of this post. For example,a granular analysis and comparison of lending patterns by geography and lender, along with a deeper exploration of chattel loans can be performed in HMDAVision.

Follow us on LinkedIn or sign-up for our mailing list for announcement of 2021 HMDAVision update.