Housing industry stakeholders - from builders to mortgage loan originators and borrowers - want to know where the population growth is, which geographies to target for building, lending, and buying a home.

To find out the answer to the question of market growth, we use U.S. Census survey data from the American Community Survey (ACS) and Current Population Survey (CPS). We also like to analyze migration patterns between geographies and over the years. According to a publication of the U.S. Census published today, less people are moving than in 1948 as percent of the population. In 2021, 8.4% of the population moved, down from 9.3% in 2020 according to the same publication. The decreasing mover rate points to a slowing growth in housing because people are moving less. But we know from recent developments that this slow down in moving could be a result of lack of affordable housing forcing people to stay put. This metric, movers rate, is measurable at more granular geographic levels like State and MSA, and Polygon Research makes the analysis easy, consistent, and reliable through its CensusVision app.

Polygon Research models the ACS, CPS, and ASEC microdata that U.S. Census publishes by sourcing it from iPUMS USA, University of Minnesota. We deliver interactive analysis of multiple years of ACS, ASEC, and monthly CPS, via our app, CensusVision. In this way, anyone interested in performing demographics/housing research will be able to do so quickly and consistently. Beyond the movers' rate, the answer to this question, i.e. "where are the growth geographies" can be answered by performing an analysis of the net migration patterns.

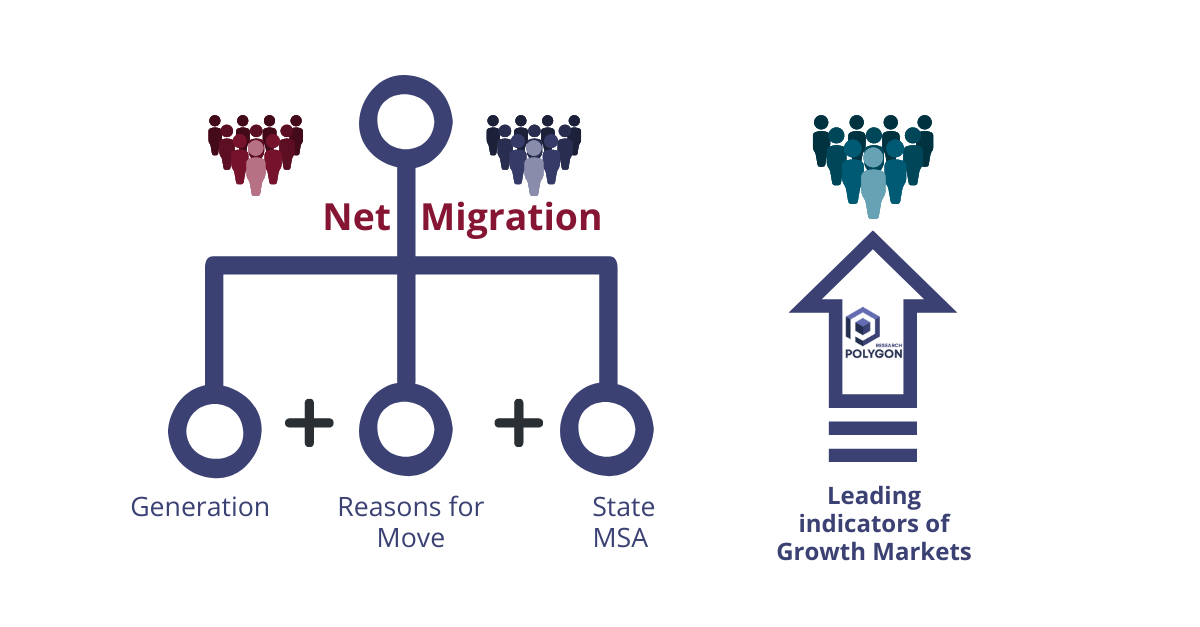

As the diagram above describes, you could rank the desired geography by net migration and by change in net migration over the years, to identify these growth markets. Then putting the filter of Generation, you could explore and understand who drives the net migration in your market (e.g. Age/Generation, but you could also use other demographic). To capture opportunity sometimes the resources have to be focused on a particular borrower/market segment. The reasons for move could be explored in the local market context for the particular demographic dimension (e.g. Generation). Having done such an analysis, the housing stakeholders have time to react with product and servicing to capture the growth opportunity from migration.

If you are interested to understand how demographics influences the housing growth in your market, schedule a 15 minute data exploration session for your particular use case.