As the mortgage industry eagerly awaits the release of the latest HMDA data, forward-thinking lenders are gearing up to capitalize on the wealth of insights it provides. While HMDA data is often viewed through the lens of compliance, its true value extends far beyond fair lending practices. In this blog post, we'll explore how HMDA data can be a game-changer for mortgage lenders, driving strategic planning, product innovation, and market dominance. We'll also introduce HMDAVision, a powerful tool that simplifies the process of extracting actionable insights from HMDA data, enabling lenders to respond swiftly to market trends and design winning strategies.

The Strategic Goldmine of HMDA Data

HMDA data is more than just a regulatory requirement; it's a strategic goldmine waiting to be tapped. Here's why:

- HMDA data provides a comprehensive view of the mortgage market, allowing lenders to identify high-potential neighborhoods, assess competitor activity, and uncover untapped opportunities.

- By analyzing loan characteristics and borrower profiles, lenders can identify gaps in their product offerings and develop targeted solutions to meet the evolving needs of specific market segments.

- HMDA data enables lenders to benchmark their pricing against competitors and make data-driven adjustments to remain competitive while maximizing profitability.

- With granular insights into borrower demographics and geographic distribution, lenders can tailor their marketing strategies to effectively reach and resonate with their target audiences.

The Challenge of Harnessing HMDA Data

Despite the immense potential of HMDA data, many lenders struggle to fully leverage its insights. The sheer volume and complexity of the data can be overwhelming, requiring significant time and resources to clean, organize, and analyze. Moreover, the lack of user-friendly tools and the need for specialized technical expertise often hinder lenders from extracting meaningful insights in a timely manner.

Enter HMDAVision

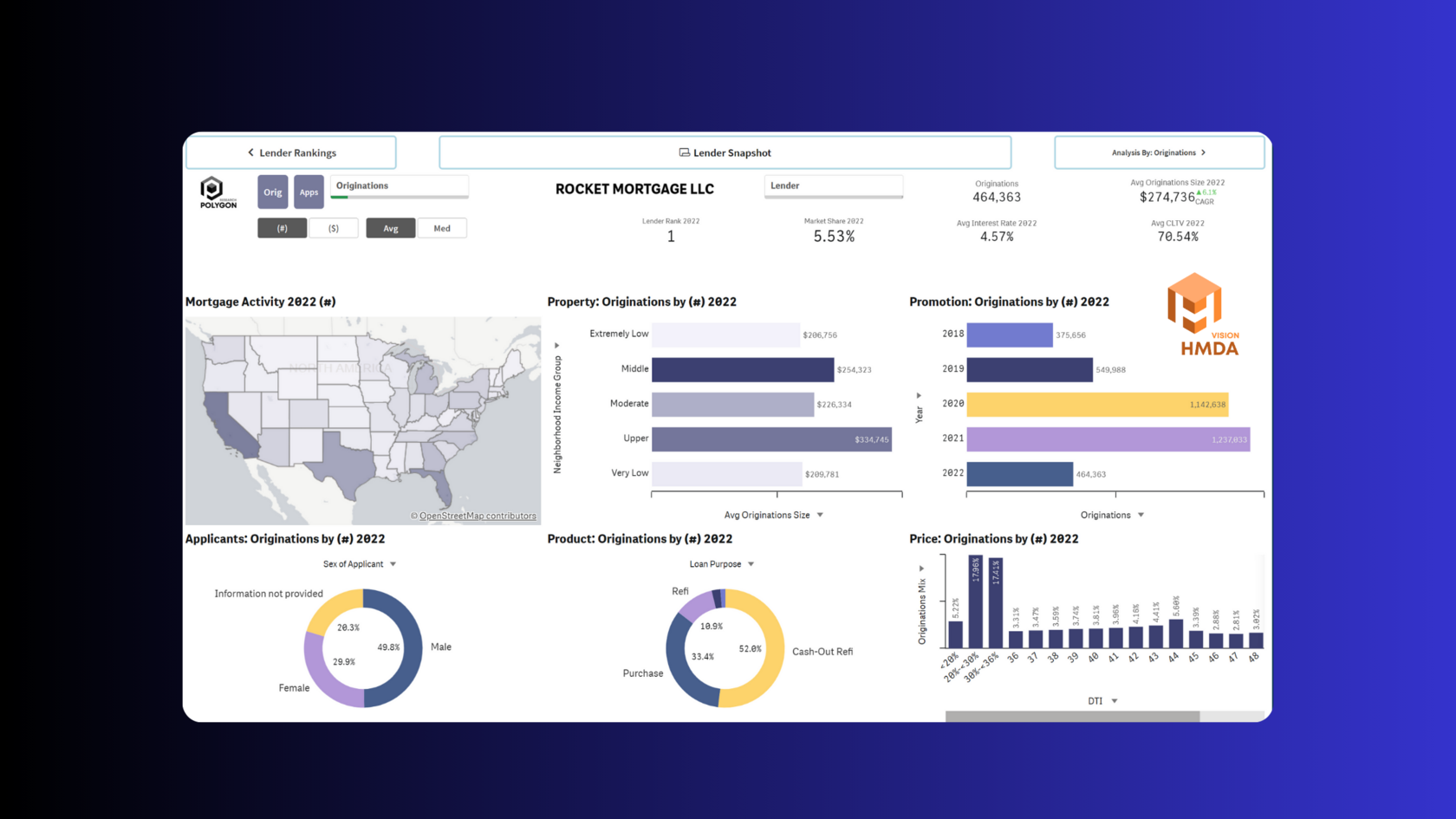

HMDAVision is a game-changing solution that empowers mortgage lenders to effortlessly harness the full potential of HMDA data. Why? Because with HMDAVision:

- Lenders access valuable loan-level data. HMDAVision provides granular, loan-level data, enabling lenders to dive deep into the details and uncover valuable insights that aggregated data may obscure.

- Lenders don't need a dedicated data science team or resources because HMDAVision seamlessly integrates demographics data. By blending HMDA data with FFIEC census data, HMDAVision adds a rich layer of demographic and socioeconomic context, allowing lenders to better understand their markets and target audiences.

- Lenders use the interactive dashboards in HMDAVision which makes it easy for product and strategy teams to brainstorm by slicing and dicing the data by geography, product type, competitor performance, borrower demographics, and more.

- Lenders improve data literacy within their organizations. With HMDAVision, lenders empower their teams with crucial understanding of the market trends at local level. HMDAVision allows for unprecedented transparency into how the data was collected and modeled. HMDAVision delivers ready-to-use insights, empowering teams to use their knowledge when drawing conclusions allowing them to make informed decisions quickly and confidently.

The HMDAVision Advantage: Driving Strategic Success

By leveraging HMDAVision, mortgage lenders can unlock a wide range of strategic advantages. They acquire competitive intelligence not only instantly but also in a cost effective way. Lenders use HMDAVision to gain a clear understanding of competitor activity, market share, and product offerings, enabling lenders to identify areas where they can differentiate and win. The power of HMDAVision is that it allows lenders to do so at every geographic level and at every market or borrower segment and in any combination.

Lenders who want to optimize their product pipelines analyze the performance of existing products across different markets and borrower segments, and develop targeted enhancements to better serve specific niches.

Since 2018, HMDA data has come with expanded pricing information. HMDAVision enables lenders to analyze the raw data in order to assess the competitiveness of pricing across geographies and products, and make data-driven adjustments to balance market share and profitability.

HMDAVision shines when it comes to fine tuning market outreach strategies. Lenders use HMDAVision to identify underserved communities and develop tailored marketing campaigns to expand access to credit and drive growth in untapped markets.

And finally, HMDAVision allows for enhanced fair lending analysis and compliance. Lenders can proactively analyze lending patterns for potential disparities and demonstrate a commitment to fair and equitable lending practices.

Lenders who want to optimize their product pipelines analyze the performance of existing products across different markets and borrower segments, and develop targeted enhancements to better serve specific niches.

Since 2018, HMDA data has come with expanded pricing information. HMDAVision enables lenders to analyze the raw data in order to assess the competitiveness of pricing across geographies and products, and make data-driven adjustments to balance market share and profitability.

HMDAVision shines when it comes to fine tuning market outreach strategies. Lenders use HMDAVision to identify underserved communities and develop tailored marketing campaigns to expand access to credit and drive growth in untapped markets.

And finally, HMDAVision allows for enhanced fair lending analysis and compliance. Lenders can proactively analyze lending patterns for potential disparities and demonstrate a commitment to fair and equitable lending practices.

As the mortgage industry becomes increasingly competitive, lenders who harness the strategic power of HMDA data will be well-positioned to thrive. HMDAVision offers a cost-effective and efficient solution for mortgage lenders to unlock the full potential of HMDA data, enabling them to make data-driven decisions, respond quickly to market trends, and design winning strategies. Don't let valuable insights slip through the cracks – embrace the power of HMDAVision and propel your lending business to new heights.

Don't miss out on the opportunity to turn HMDA data into your competitive advantage. Call us to set up a demo and experience firsthand how it can transform your mortgage lending business.

Don't miss out on the opportunity to turn HMDA data into your competitive advantage. Call us to set up a demo and experience firsthand how it can transform your mortgage lending business.