Open data is a game-changer in today's world, and at Polygon Research, we're at the forefront of harnessing it for the housing finance and mortgage banking stakeholders. Our expertise shines in making the Federal Reserve's Survey of Consumer Finances (SCF) – a public treasure trove of data – immensely useful for industry professionals. Just last week, our CTO joined an esteemed panel at the 2023 Hispanic Wealth Symposium, alongside Jake Krimmel, Ph.D., Economist, Microeconomic Surveys, Federal Reserve Board, José Espaillat, Diverse Segments Head of Affluent Markets, Wells Fargo Wealth & Investment Management, and Elizabeth Nimmons, Ph.D., Senior Policy & Research Analyst, NAHREP.

Unlocking the Potential of SCF Open Data

The SCF survey, with its open-access nature, presents a wealth of opportunities, yet its full potential is often overlooked. We specialize in digging deep into this data to uncover insights that directly benefit mortgage bankers and their clients.

Transforming Mortgage Banking with Data-Driven Insights

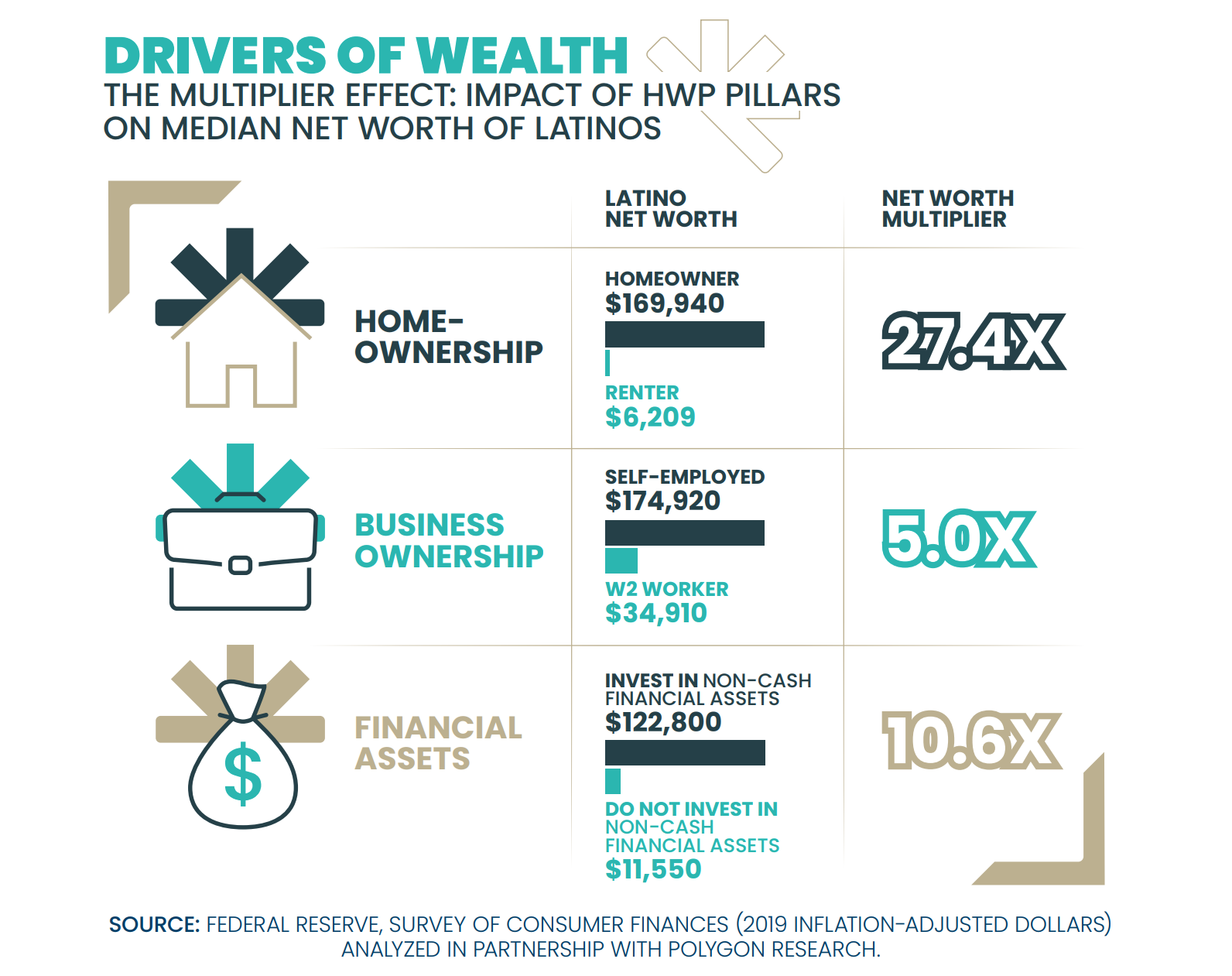

Our focus is on converting raw SCF data into meaningful, actionable strategies. This approach is revolutionizing how mortgage products are designed, marketed, and tailored to diverse consumer needs. For example, most recently, Polygon Research contributed to the State of Hispanic Wealth Report: Drivers of Wealth.

Our in-depth analysis enables mortgage bankers to craft innovative solutions that resonate with the financial realities of various consumer groups, particularly in underserved communities.

Polygon Research at the Hispanic Wealth Symposium

The participation of our CTO in the panel discussion was a highlight for us, showcasing our expertise in data interpretation. Sharing insights with industry leaders like Jake Krimmel, Ph.D., Economist, Microeconomic Surveys, Federal Reserve Board, José Espaillat, Diverse Segments Head of Affluent Markets, Wells Fargo, Elizabeth Nimmons, Ph.D., Senior Policy & Research Analyst, NAHREP, and moderated by Jason Riveiro, NAHREP’s Executive Director underscored the value of SCF data in developing targeted strategies for the Hispanic market in mortgage banking. The panel was a rich exchange of ideas and strategies, offering a glimpse into how SCF data can drive growth and inclusivity in the mortgage sector.

The Road Ahead

The dynamic nature of the financial landscape demands continuous innovation and adaptation. By leveraging open data like the SCF survey, we at Polygon Research are committed to staying ahead of the curve, equipping mortgage bankers with the insights necessary for informed decision-making and strategic growth.

Join Our Conversation

Thank you for tuning into our blog. We're thrilled to continue exploring the intersection of open data and mortgage banking with you. If you have any questions or thoughts about the SCF survey and its impact on the industry, we welcome your input. Feel free to reach out to us directly: info@polygonresearch.com.