Well, we’re not doctors, but 2022 wasn’t exactly a great year for mortgage lending.

Based on the just-published HMDA data, originations were just shy of 8.4 millions loans, which is somewhere between 2018 and 2019 levels, but a 44.44% drop from last year. Of those, 6.9 million were first liens, and 1.4 million were second liens – almost all of them HELOCs.

ARMs were more popular in 2022 than in 2021 – to the tune of 26% more first lien ARMs being originated in 2022 than 2021.

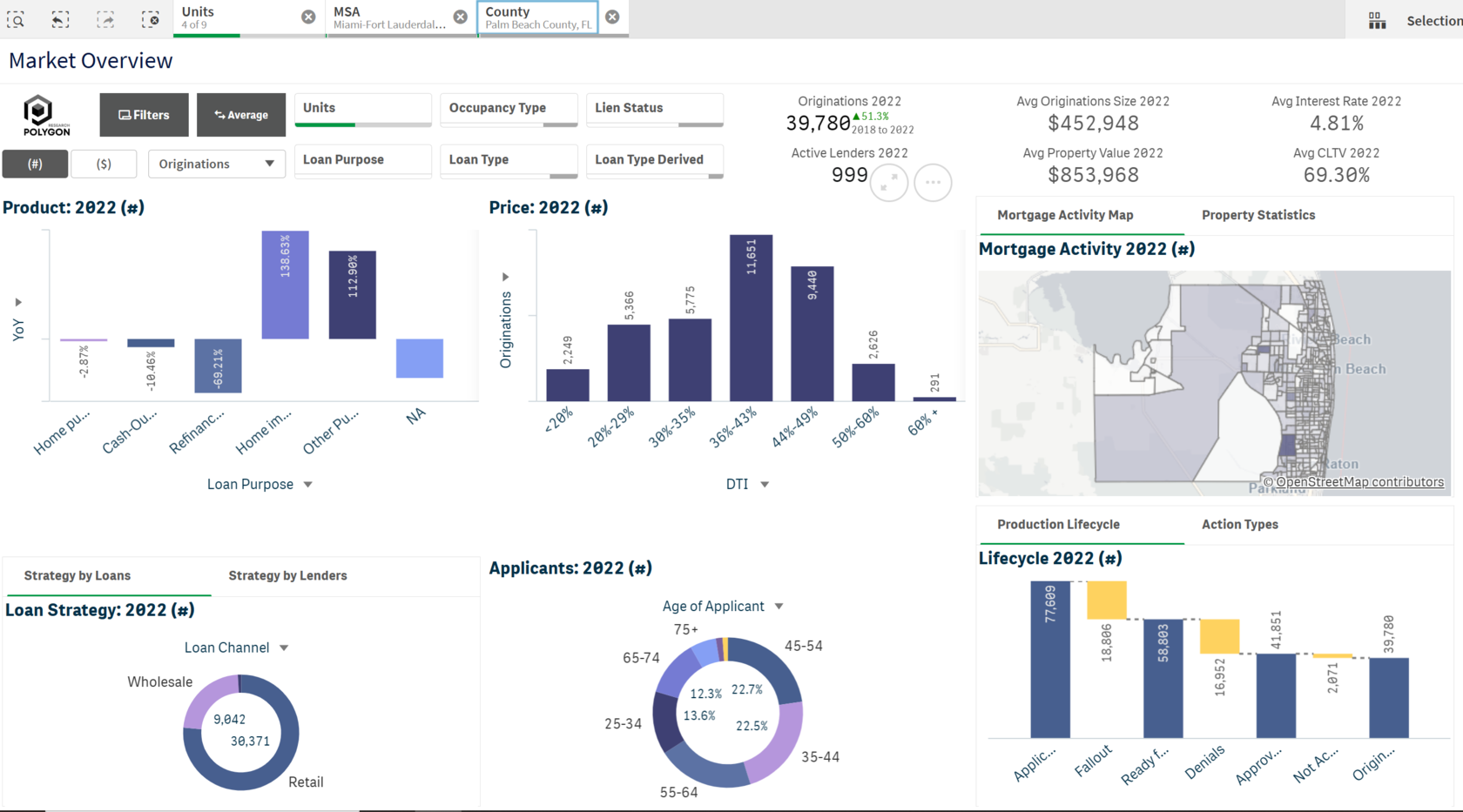

DTIs were on the rise. Although the number of loans with DTIs between 36% and 50% fell year over year in 2022, they fell less than the overall change in originations – meaning that we saw more origination mix fall in those buckets. The level of originations above 50% DTI is up from last year, no doubt as a result of the rise in mortgage rates.

ARMs were more popular in 2022 than in 2021 – to the tune of 26% more first lien ARMs being originated in 2022 than 2021.

DTIs were on the rise. Although the number of loans with DTIs between 36% and 50% fell year over year in 2022, they fell less than the overall change in originations – meaning that we saw more origination mix fall in those buckets. The level of originations above 50% DTI is up from last year, no doubt as a result of the rise in mortgage rates.

How bad did the first lien refi situation get? 2022

2022 represented a decline of over 83% compared to 2021.

So is there any good news?

The good news is that it took just a couple of minutes to arrive at those insights, with most of that time being spent deciding what news we wanted to share. Better still, every single one of those insights was arrived at with a few mouse clicks and no typing. Everything came from a single HMDAVision dashboard, and even then we only used two out of the six charts. Just a few clicks are all that stands between you and these sorts of insights.

Remember how we said the HMDA data was just published? Well, there’s more good news – these numbers get updated as lenders file corrections and late filers trickle in, and our customers aren’t going to need to lift a finger. Our dashboards will automatically update for them, and if they have saved filter settings, those will still be there waiting for them as well. We built HMDAVision to enable people to do great things with all the time they save when working with a huge dataset. Understand, compete, win, repeat: taking data wrangling out of this cycle is the secret sauce to making it work. We’ve got you covered.

So 2022 was a pretty bad year for mortgage lending. What do we know about 2023?

- Competition is going to be fierce;

- Consolidation is going to continue; and

- To survive in this market, you need to understand the market.

The best way to understand the market is going to be to have powerful data at your fingertips. You need to be able to drill down to understand local markets as well as your competition. The days of borrowers beating down your door are over – for now. Thankfully we have the tools you need to enable powerful data analysis, even if you’re having to do more with less.

If we were doctors, we’d take this time to urge you to schedule an appointment to get checked out - but we’re not. So instead, we’re going to urge you to schedule an appointment to check us out. Let us show you what HMDAVision can do, and while we’re at it, let us show you some of the other tools we have to help you succeed. Email us at info@polygonresearch.com or visit our website (https://www.polygonresearch.com). We can’t do anything about the mortgage market, but perhaps our tools will help relieve that stress of finding opportunity in times like these.