The U.S. is an incredibly powerful melting pot of different cultures, ethnicities, races. Such a dynamic societal environment fosters the free exchange of ideas and competition that drive innovation and new discoveries. There is a risk - perhaps a blind spot - though, of limiting ourselves to networks and circles that do not exhibit or enjoy the great diversity our nation has to offer.

In mortgage lending, as in other industries, this could manifest in how you recruit, in how you formulate and execute your marketing plan, and in where you look for leads.

In this blog, we want to address the "I" in the MCGI framework - "Include". There is so much talk about diversity and inclusion (D&I or DEI) in the mortgage industry that the speeches, the remarks, the news stories, and the thick research pdf's run the risk of turning into background noise and not delivering the intended results. But we believe there is a way to do more walking than talking when it comes to inclusion.

How do you do more walking and less talking?

We all want a magic pill to solve whatever pain we have at the moment. But when it comes down to real healing, often we have to walk the extra mile of learning and of trying a variety of options before we find the cure for the particular ailment. In the context of real estate finance / mortgage banking, it starts with widening the funnel of mortgage applications (in the loan production area) and with widening the funnel of human applications for jobs at stakeholder organizations.

In both cases, knowledge and awareness of the local demographic makeup of the market served is essential. To test your knowledge, answer the following two questions:

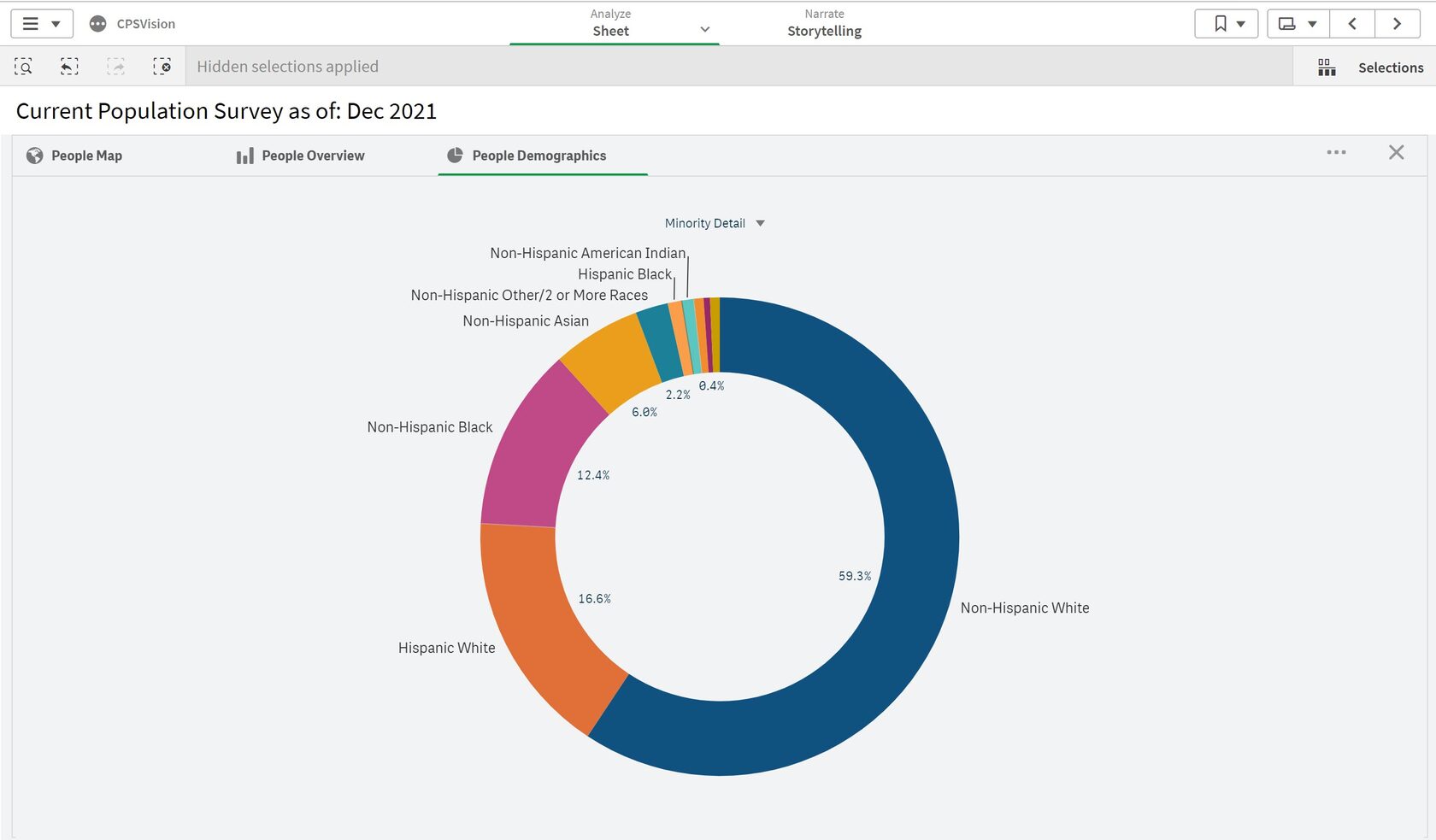

#1 What is the current diversity at the national level? (the answer is in the figure below)

#2 How does this compare to my local market? (you need to do the work to get to know your community to answer this question)

By investing in understanding the subtleties of your community, you stand to gain perspective and appreciation of the people around you and your lending business. When business development officers, account executives, and loan originators are armed with interactive insights, they gain real-time understanding of their communities' housing and lending patterns - empowering them to do more walking and less talking.

From a compliance perspective, a lender's investment in embedding interactive insights of demographics, housing, and lending patterns, and actively supporting outreach to everyone in the community is an example of the "all hands-on deck" imperative from regulators at the end of 2021, including the Acting Comptroller of the Currency Michael Hsu. Last week the Mortgage Bankers Association (MBA) hosted a three-part webinar on fair lending, which in part focused on the concern of "modern redlining", one that is "often more subtle, harder to detect, and resource-intensive to find" (Hsu). This subtle redlining can be combatted - and even better, avoided in the first place - by involving everyone in the effort, and by equipping teams with tools and resources to know, to build relationships within, and to serve their local markets.

Figure: U.S. Population Diversity

The "I", "Include", in the MCGI framework is a good business practice. Consider our claim in the title of this post that the whole is greater than the sum of its parts. We have about 130 million households in the US, and our homeownership rate is 65.8% (based on Polygon Research's tabulation of ASEC March 2021 data). Compared to the national average homeownership rate, the minority homeownership rate, 50.3%, is a good deal lower. There is good will among regulators, lenders, non-profits, and much of the general public to increase minority homeownership. The delta with the national homeownership rate is 15.5 percentage points. One way to look at this is that about 7 million households need to become owned (instead of rented) in order to close that delta. This is a fantastic business opportunity! To take advantage of the opportunity both for social purposes and for business purposes, stakeholders need to act locally and make a concerted outreach effort. Empowering stakeholders with interactive data insights improves innovation, accountability, and transparency.

So if you are enjoined, again in the words of Hsu, toward "marshalling all of our forces and resources to root it [redlining] out and stop it", a great answer is "come on in, the water's great."

Polygon Research has a scalable platform with curated market intel apps that are affordable and equally accessible to government, non-profits, and the private sector. We remove the barrier to insight from the equation, and create an opportunity for new, constructive conversations with real impact. You can schedule a 15 minute brainstorming session with us if you want to embed thoughtful business practices for the next generation of mortgage banking.