We got curious about the vacation home market after reading a fun article on realtor.com about vacation home destination based on research of mortgage applications data. We used the newly published 2021 HMDA data in HMDAVision to do our own analysis and give our own take on the vacation home buying market from the mortgage lending perspective.

We used HMDAVision

In HMDAVision, we can analyze:

- the property value of the vacation (second homes) that the mortgage underwriting was based on

- the median mortgage on a vacation home (second home)

- the type of mortgage used to finance the purchase of a vacation home (second home)

- the mortgage pricing such as interest rate spread, fees, points, credits, and loan costs

- the demographics of the buyer such as age, sex, income, ethnicity, and race

- the most active lenders in this market

- And much more!

We will explore just a few of these items in our blog today. Using HMDAVision, it took us 10 minutes to understand the second-home (vacation) lending market in Wisconsin.

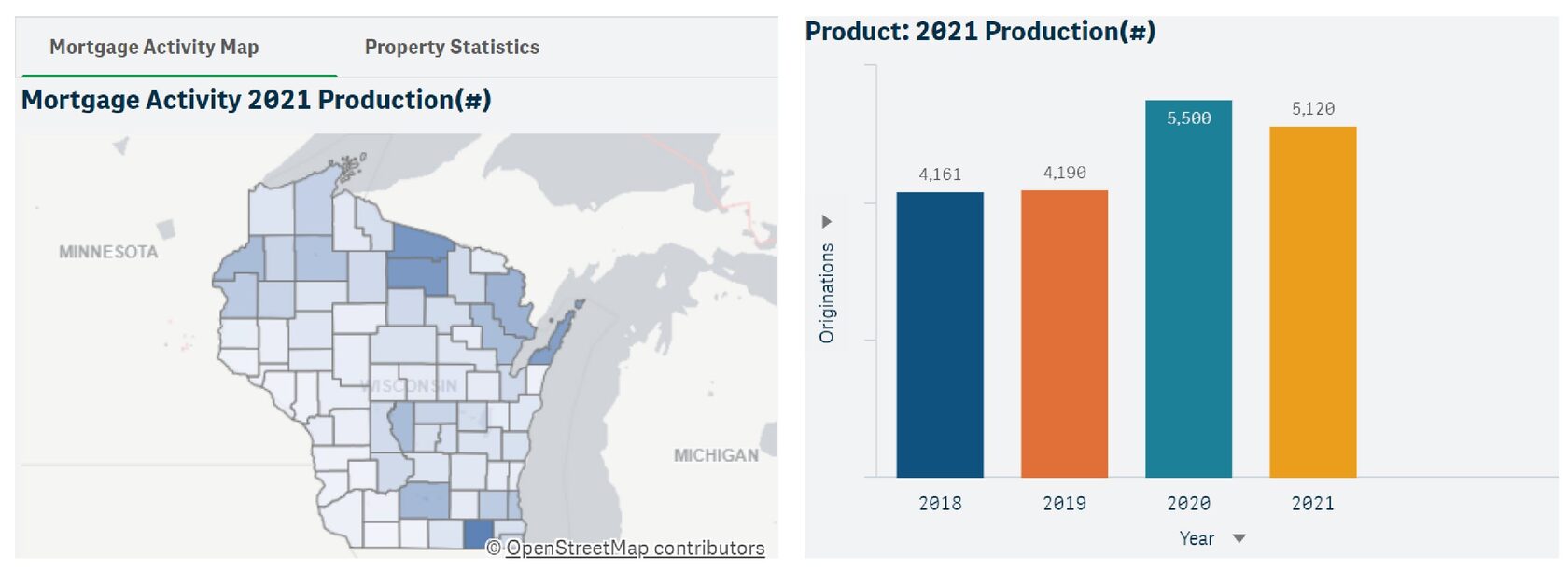

Fig.1: 2021 overall vacation purchase mortgage lending market in Wisconsin

As shown above, the 2021 vacation purchase lending market in WI was comprised of 5,120 loans. This was 6.91% lower than 2020, but overall, the vacation purchase market in WI has been growing at 7.2% CAGR since 2018.

The 2021 loan volume of vacation purchase lending in WI was $1.42 Billion. The median loan amount was about $225,000. 93% of all purchase mortgage loans for second homes were conventional loans, 6% of them were Jumbo, 0.8% were HELOC, and only one loan was FHA-insured.

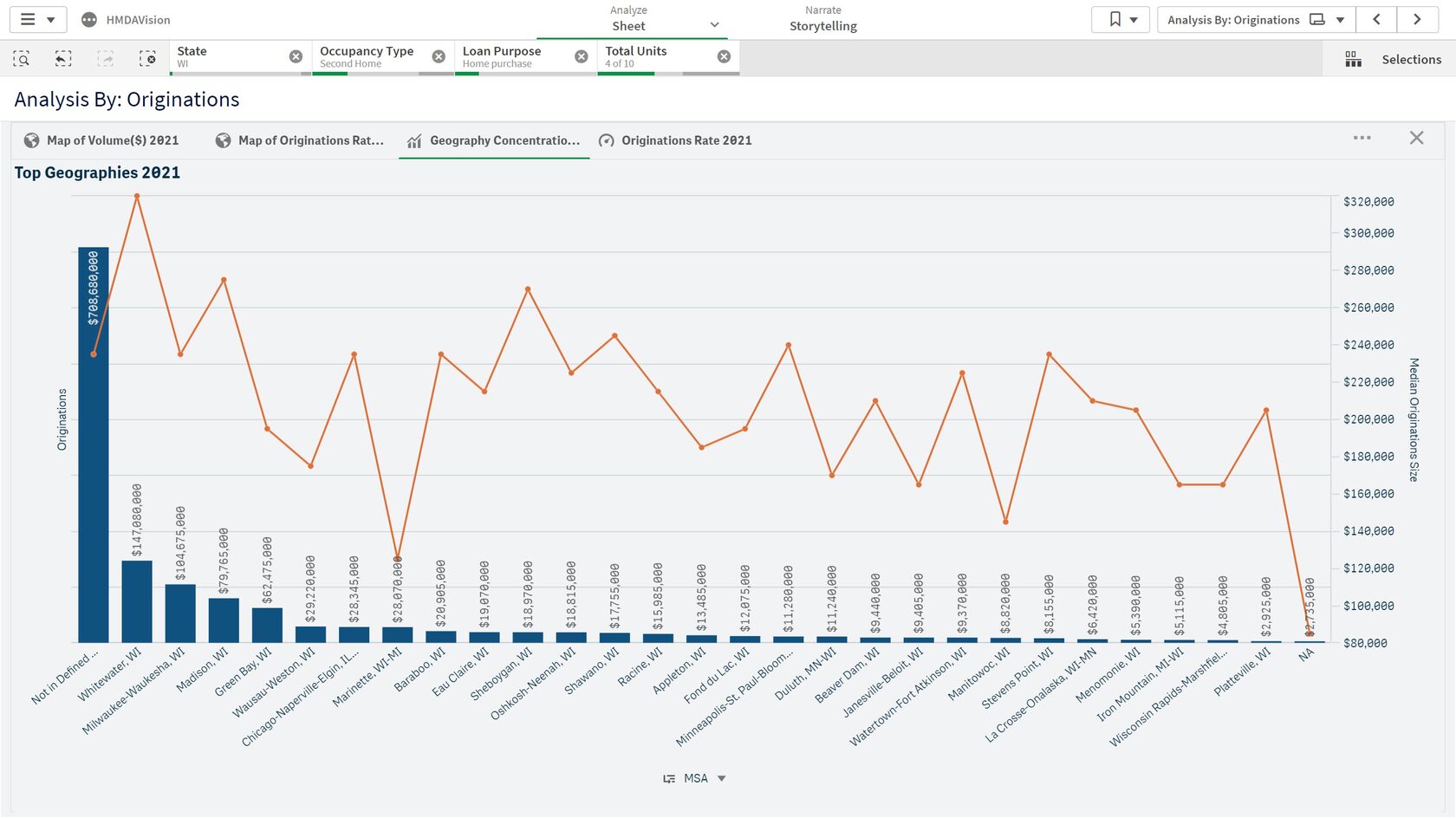

Where were vacation home buyers buying second homes with mortgage?

Similarly to realtor.com, we found that, excluding areas outside of MSAs, Whitewater, WI was attracting the most interest from second-home buyers who used a mortgage to finance their home purchase.

Fig.2: 2021 Second Home Purchase Mortgage Lending by MSAs (includes lending outside of MSAs).

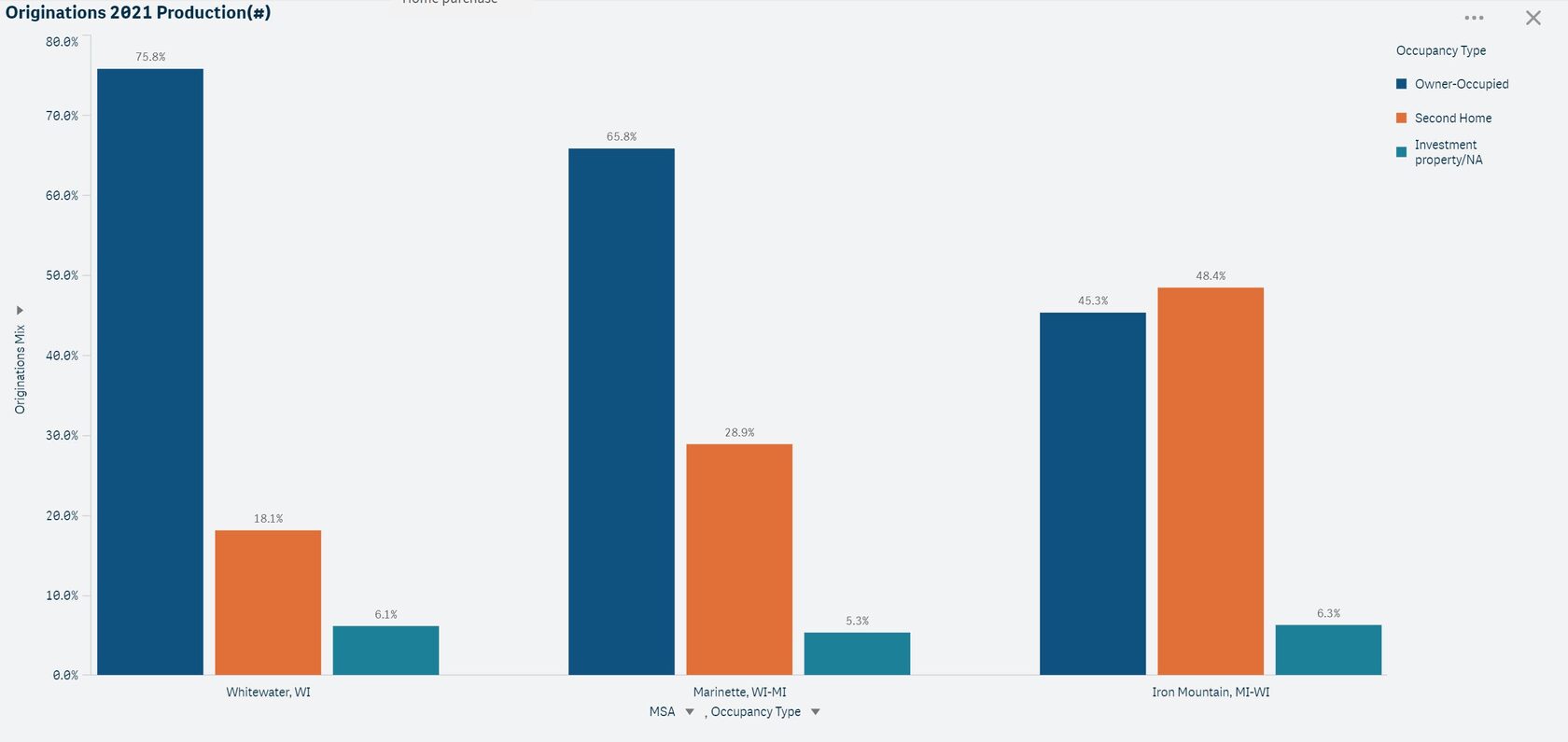

What other markets in Wisconsin are considered vacation home buying areas?

According to the realtor.com article's methodology, "to be considered a vacation area, second-home sales had to make up at least 20% of all home purchase loans...", So we took a look at that question (second home share of home purchase loans, 1-4 units) by MSA. Here is what we've found. In addition to Whitewater, WI, there are 3 other MSAs, as shown below.

Fig.3: 2021 Wisconsin MSAs with High Share of Second-homes

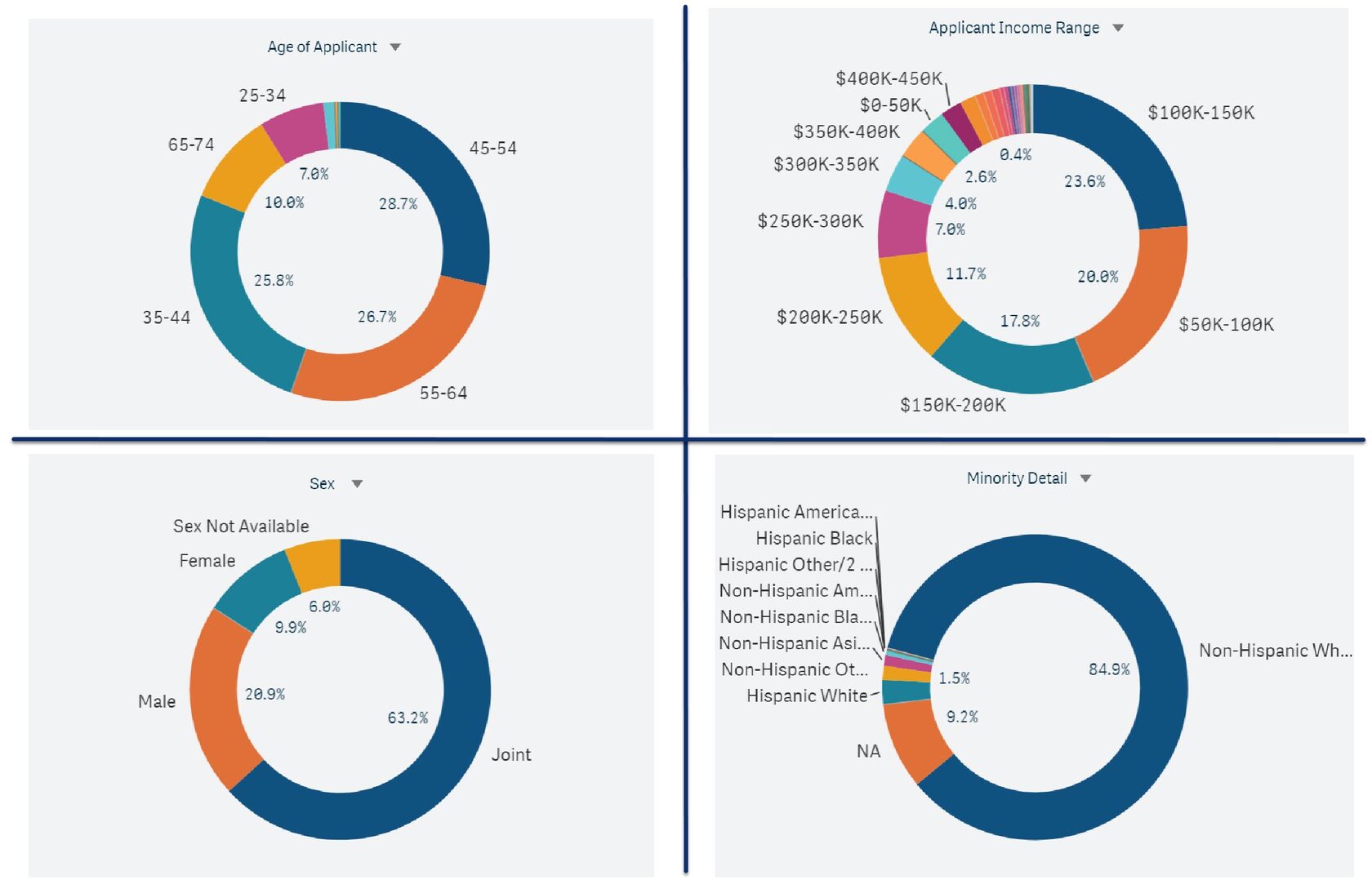

Who is buying vacation homes in Wisconsin?

As shown below, about 93% of all vacation home buyers in Wisconsin are 35 years old or older. 77% of them have a household income of $100k or over. Women represent just under 10% of all vacation home buyers in Wisconsin.Fig. 4: 2021 Demographics of Vacation Home Buyers in Wisconsin

As the realtor.com article points out, when we analyze mortgage data, we naturally don't include the cash deals. You can use MLS data for cash transactions, or you can achieve ~90% accuracy by turning to census data. We use American Community Survey (ACS) data for this type of analysis. We will be updating our product, CensusVision with ACS-5YR PUMS data as soon as it is out in just a couple of days. Our users who subscribe to our HMDA + Census Bundle, have the opportunity to also analyze all MSA markets for:

- Cash transactions

- Relocation trends into the MSA

- Property characteristics - number of units

- Detailed demographics of the buyers - not only their age, sex, income, ethnicity, and race; but also their marital status, industry, occupation, veteran status, among many other attributes.

Schedule 15 minutes with us to discuss how to find out which markets in your sales territory are vacation home buying opportunities.