Driven by record refi activity, March 2021 is the best month of March for single-family FHA originations from 2010 forward. However, March 2021 was the fourth best month for FHA purchase originations since 2010 with 65,044 FHA purchase loans.

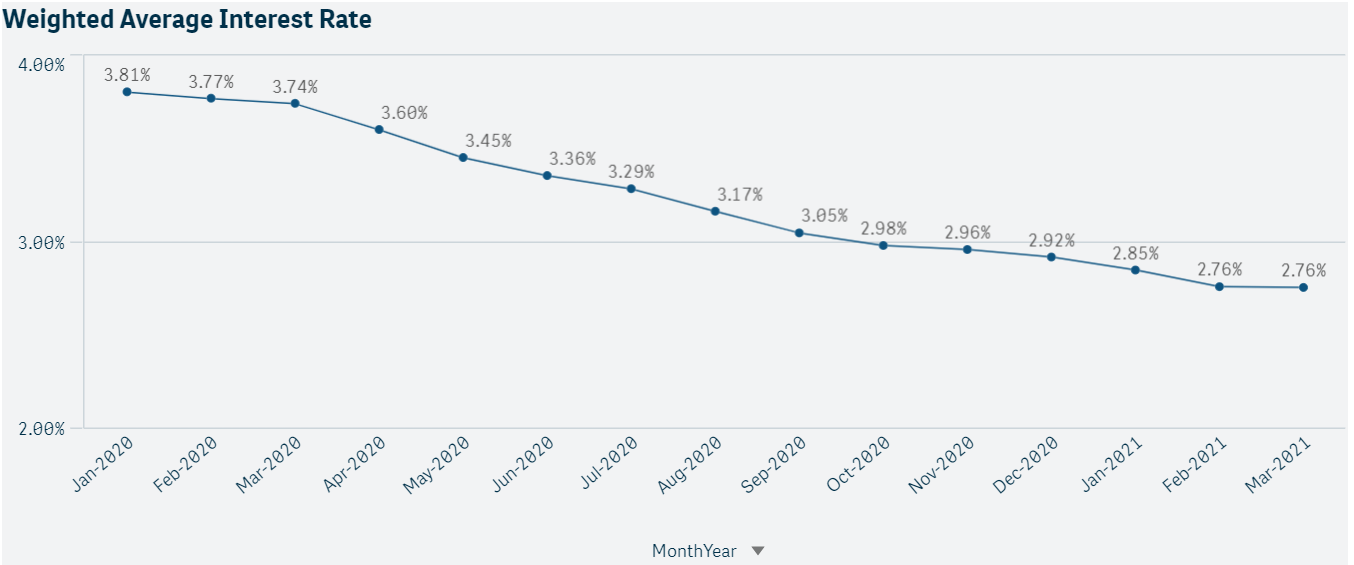

2021 year-to-date, FHA total loans originated (purchase and refi) were 358,389 or $85.5 Billion in loan volume. The FHA purchase mix Q1 2021 was 50.5%, lower than the FHA purchase mix in Q1 2020 which was 58%. In March 2021, for the first time since last year, the FHA weighted average interest rate leveled off at 2.76%.

Here is where you can download the full-length FHA infographic: Products (polygonresearch.com)