It’s been 55 years since the signing of the Fair Housing Act, which is a component of the Civil Rights Act of 1968. Originally, it prohibited housing discrimination on the basis of race, religion, national, and national origin. In 1974, it was expanded to address discrimination on the basis of sex, and in 1998 protection was provided to those with disabilities and families with children. We’ve come a long way since then, and yet there is still much progress to be made in terms of homeownership rates amongst various groups.

While overt and intentional discrimination in mortgage finance is an important topic that needs to be dealt with, we also need to consider what we can do as an industry to not only maximize our reach to mortgage-ready borrowers, but to help create a pipeline of people who are the mortgage-ready borrowers of tomorrow.

Setting aside the obvious societal good, we’re talking about reaching more customers and being in a position to create new ones. It’s simply good business.

One approach to this is to rely upon assumptions about various communities, and throw everything against the wall to see what sticks. Not only is this likely to be ineffective, but it’s costly. Instead, you want to approach this from an informed perspective using data and analytics.

That’s where we come in.

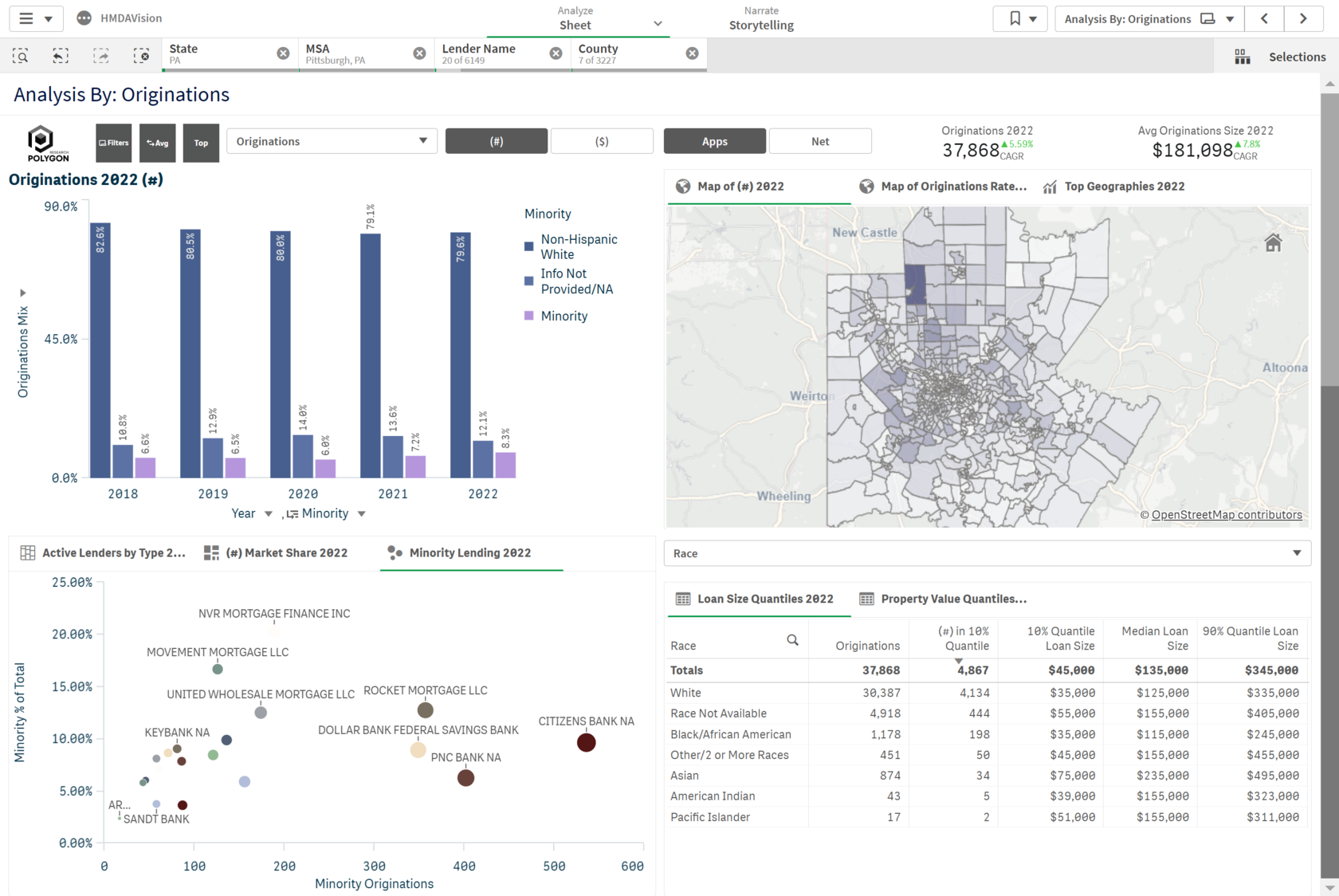

Our HMDAVision product contains various views that help you identify the borrower segments you are missing. You can compare your origination trends versus the demographics of your lending footprint, or discover census tracts where your competition is outperforming you. What’s more, you can explore denial data to get a better understanding of the barriers your potential customers are facing, which can help your loan officers become valued advisors to help turn applicants into borrowers.

But maybe you’ve already looked in the mirror, and are well informed about your performance. You can then turn your gaze to the competition, figuring out where they are finding success and the segments of the market they are neglecting.

Or perhaps you aren’t even in the business of making loans. The tools we offer are just as powerful in the hands of researchers and those interested in public policy, enabling them to focus on asking the important questions to help advance our society.

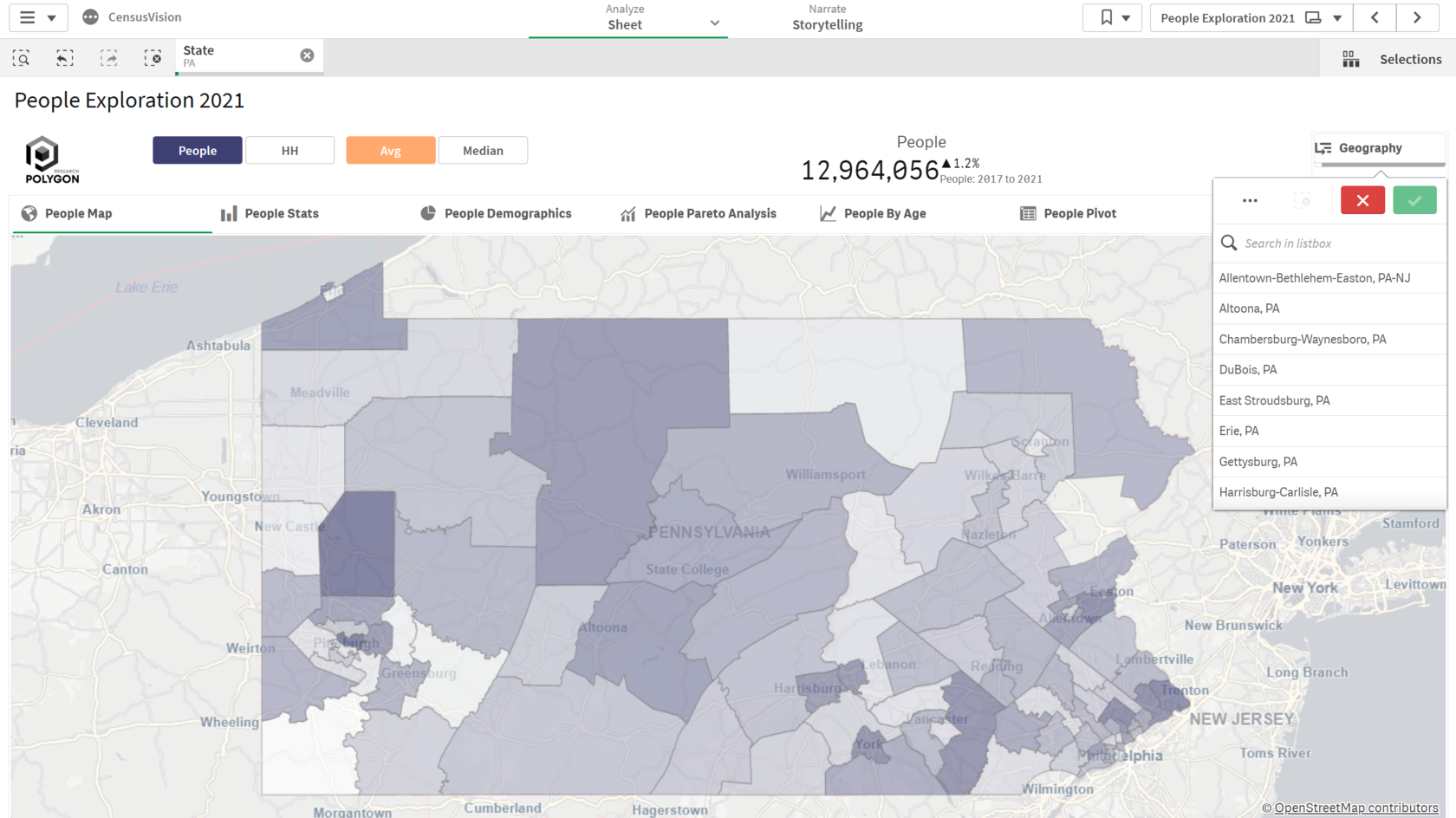

As powerful as HMDAVision is, we have other tools that provide great insights, such as CRAVision which gives banking stakeholders an interactive tool for mapping assessment areas and understanding CRA patterns and trends. We also have CensusVision and CPSVision that bring the U.S. Census PUMS data at your fingertips to answer questions about demographic changes and housing affordability specific to your market. We also have a SPCP Analytics-In-A-Box offering that enables you to produce repeatable, consistent, and accurate documentation of the need for a Special Purpose Credit Program, and which can help ease the product development process.

As we celebrate 55 years of the Fair Housing Act, let’s all stop to think about what we can do to help ensure that we are acting in furtherance of its ideals. If you’re interested in leaning into creating opportunity, please reach out so that we can show you how our products can speed your analysis and help drive insight. Email us at info@polygonresearch.com or visit our website (https://www.polygonresearch.com) to schedule a demo.